Economy flies blind without jobs data, unemployment claims during government shutdown

NegativeFinancial Markets

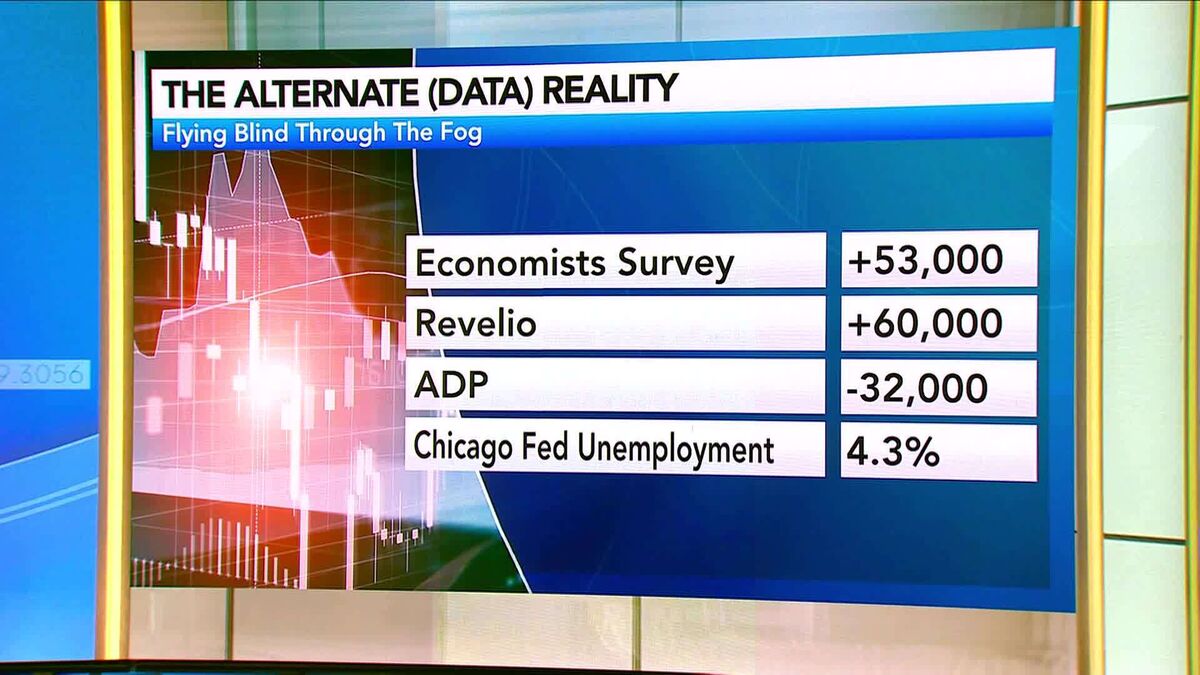

The recent government shutdown has left the economy in a precarious position, as critical jobs data and unemployment claims are unavailable. Jerome Powell highlighted the importance of timely data for making informed decisions, emphasizing that each month is vital for economic assessment. This situation raises concerns about the potential impact on policy-making and economic stability, as the lack of data could hinder efforts to address unemployment and growth.

— Curated by the World Pulse Now AI Editorial System