Government Shutdown Leaves Wall Street Without Jobs Data

NegativeFinancial Markets

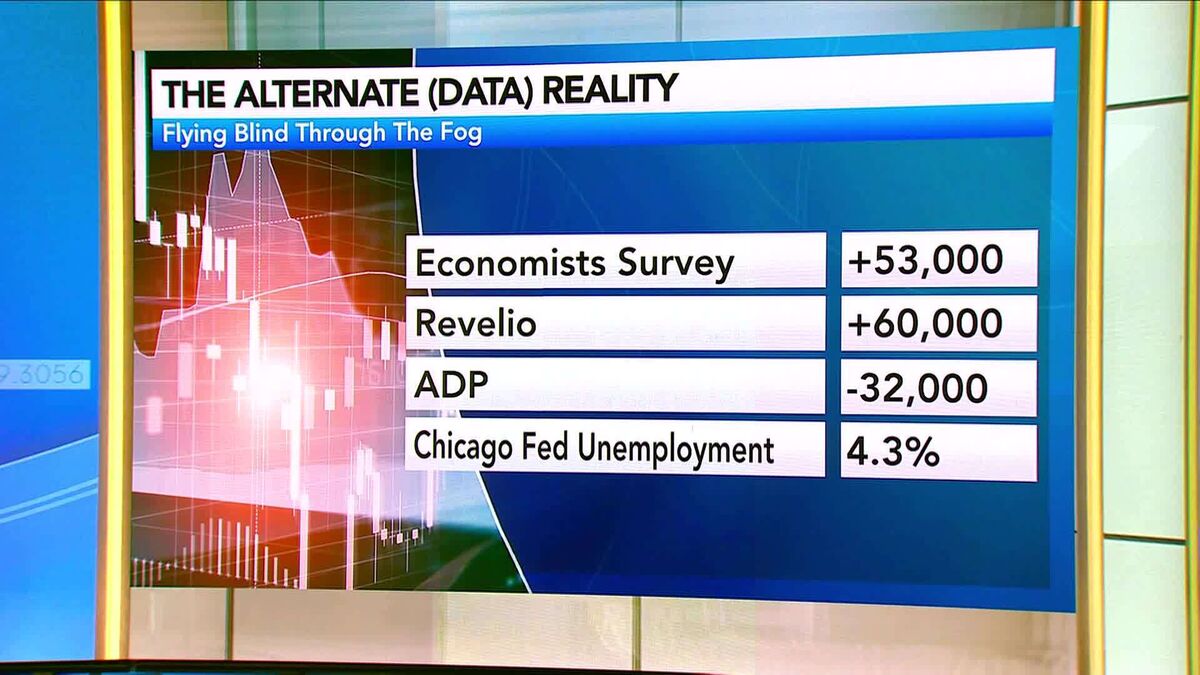

The recent government shutdown has left Wall Street in a lurch, as crucial jobs data is unavailable. This situation is concerning because accurate employment statistics are vital for investors and policymakers to gauge the health of the economy. Without this data, market predictions become uncertain, potentially leading to volatility in financial markets.

— Curated by the World Pulse Now AI Editorial System