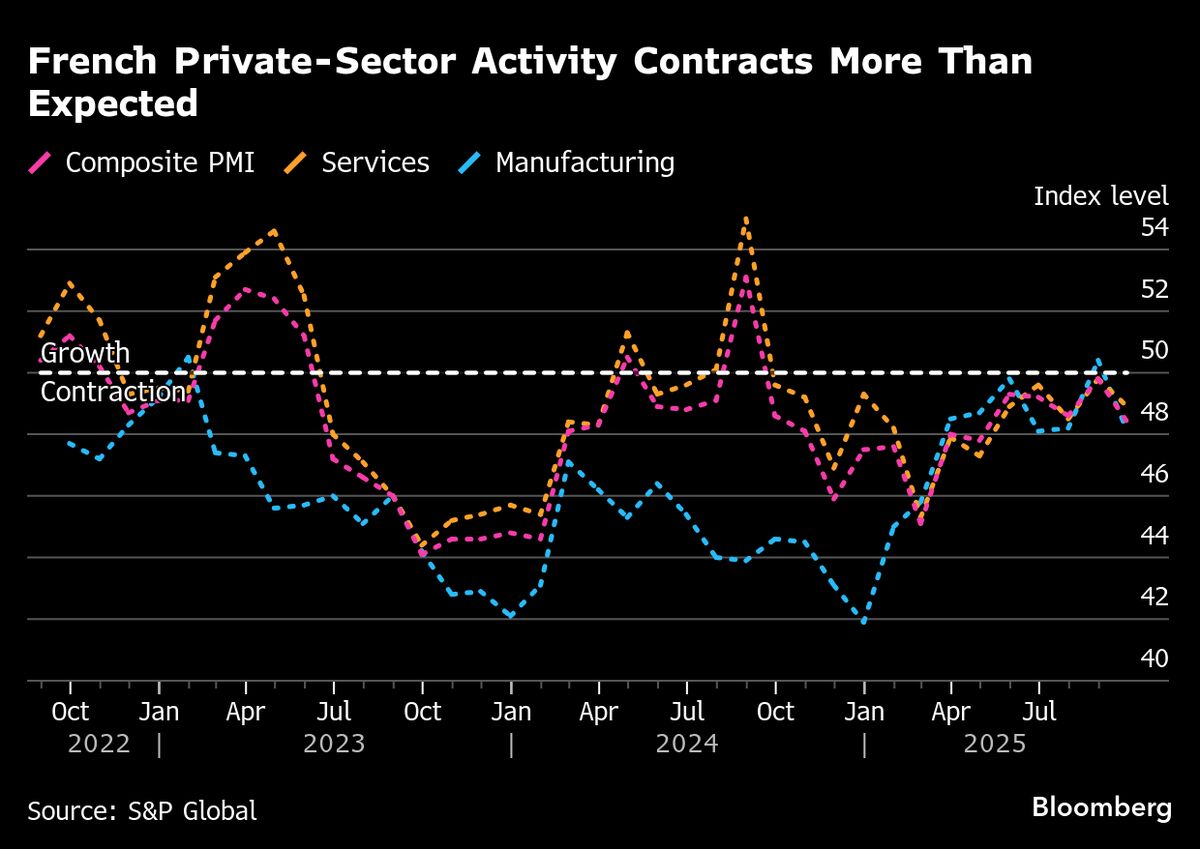

French Private Sector Sinks More Than Expected on Political Mess

NegativeFinancial Markets

French private-sector activity has dropped to its lowest level in five months, reflecting the impact of ongoing political turmoil in the country. This decline is significant as it indicates growing instability that could affect economic growth and investor confidence, raising concerns about the future of the French economy.

— Curated by the World Pulse Now AI Editorial System