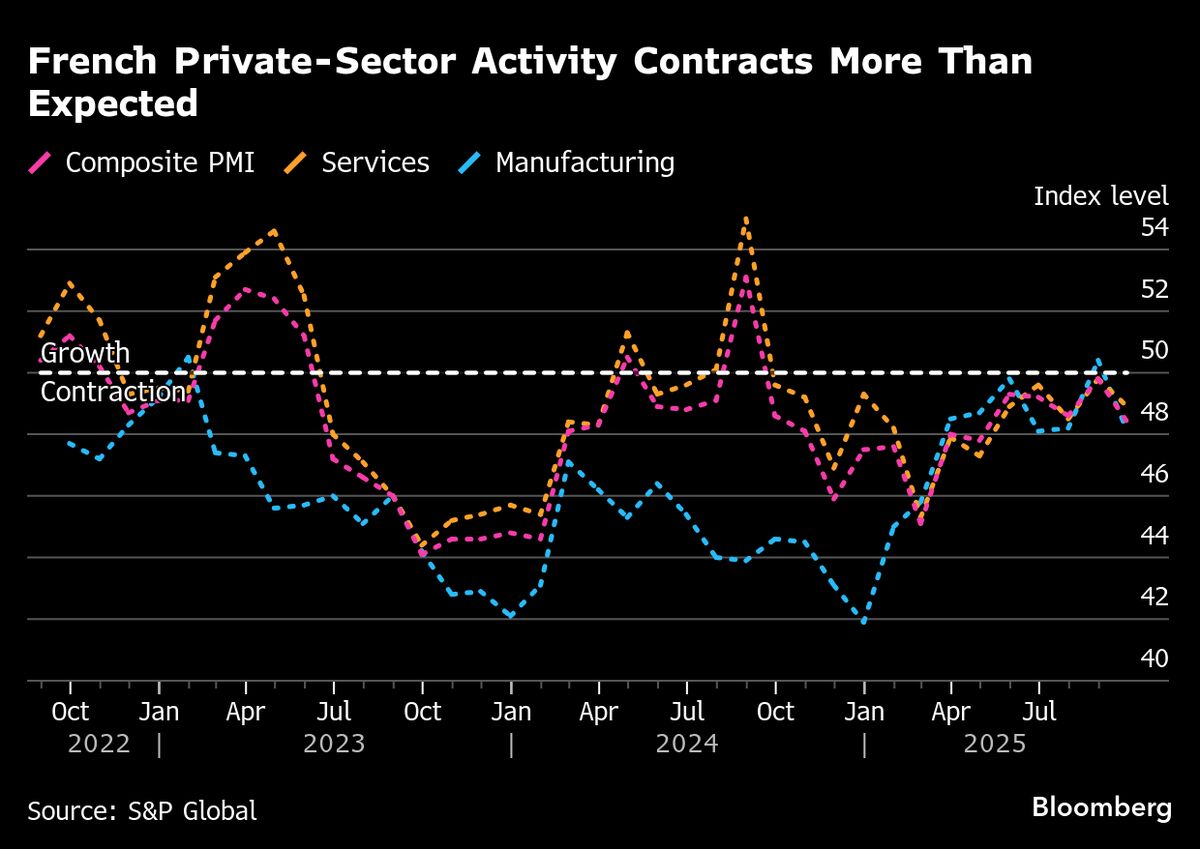

French economic activity contracts at fastest pace since April - PMI

NegativeFinancial Markets

Recent data reveals that French economic activity has contracted at its fastest pace since April, according to the latest PMI report. This decline is significant as it indicates a slowdown in the economy, which could have broader implications for employment and consumer confidence. Understanding these trends is crucial for businesses and policymakers as they navigate the challenges ahead.

— Curated by the World Pulse Now AI Editorial System