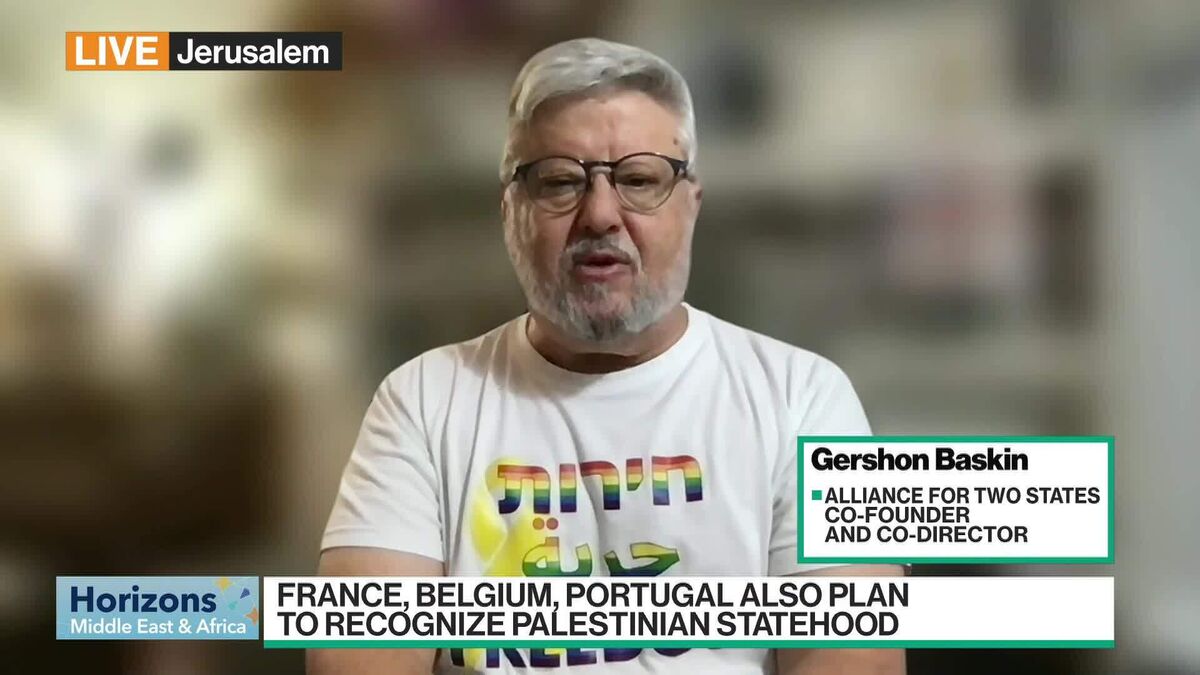

France recognises Palestinian statehood and calls for end to Israeli war in Gaza

PositiveFinancial Markets

France has officially recognized Palestinian statehood, with President Emmanuel Macron emphasizing that 'nothing justifies' the ongoing conflict in Gaza. This move is significant as it reflects France's commitment to peace and stability in the region, urging an end to hostilities and advocating for a two-state solution. By taking this stance, France aims to encourage dialogue and support for Palestinian rights, which could influence other nations to reconsider their positions.

— Curated by the World Pulse Now AI Editorial System