Hong Kong Funding Cost Seen Sliding on Fed Cuts, Slow Lending

PositiveFinancial Markets

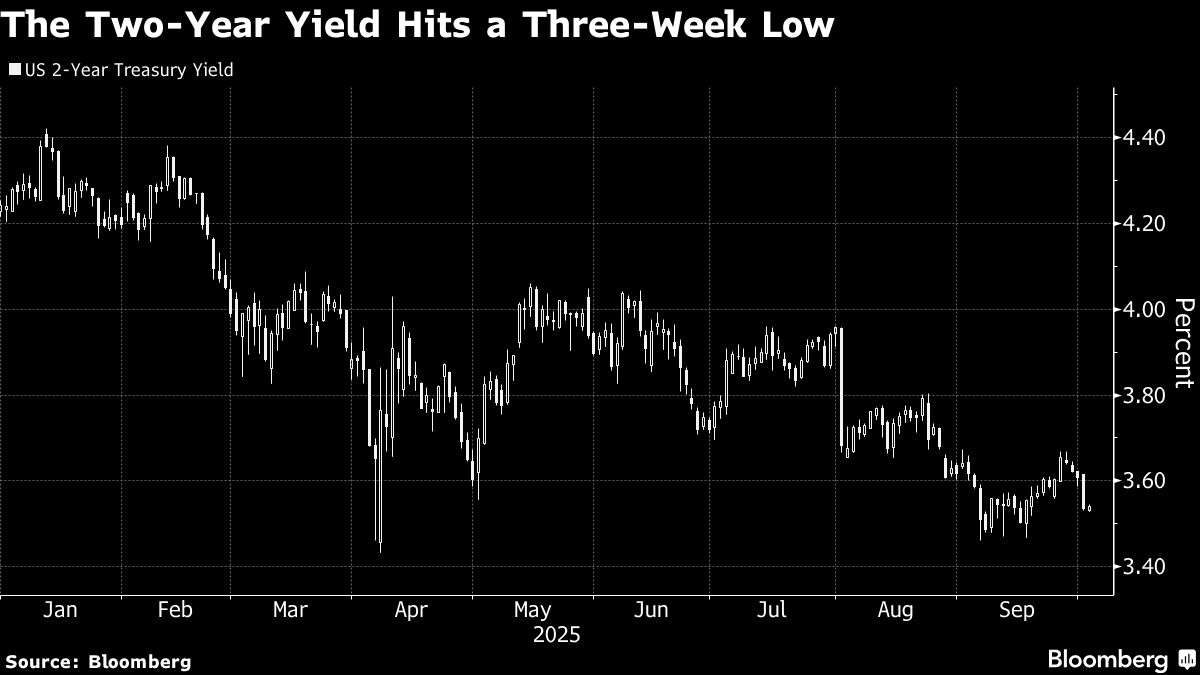

Analysts predict that the cost of overnight borrowing in Hong Kong may decrease to around 3% by the end of the year. This potential drop is attributed to anticipated interest-rate cuts by the Federal Reserve and a slowdown in loan demand. Such a decline in borrowing costs could stimulate economic activity and provide relief to businesses and consumers alike, making it an important development for the region's financial landscape.

— Curated by the World Pulse Now AI Editorial System