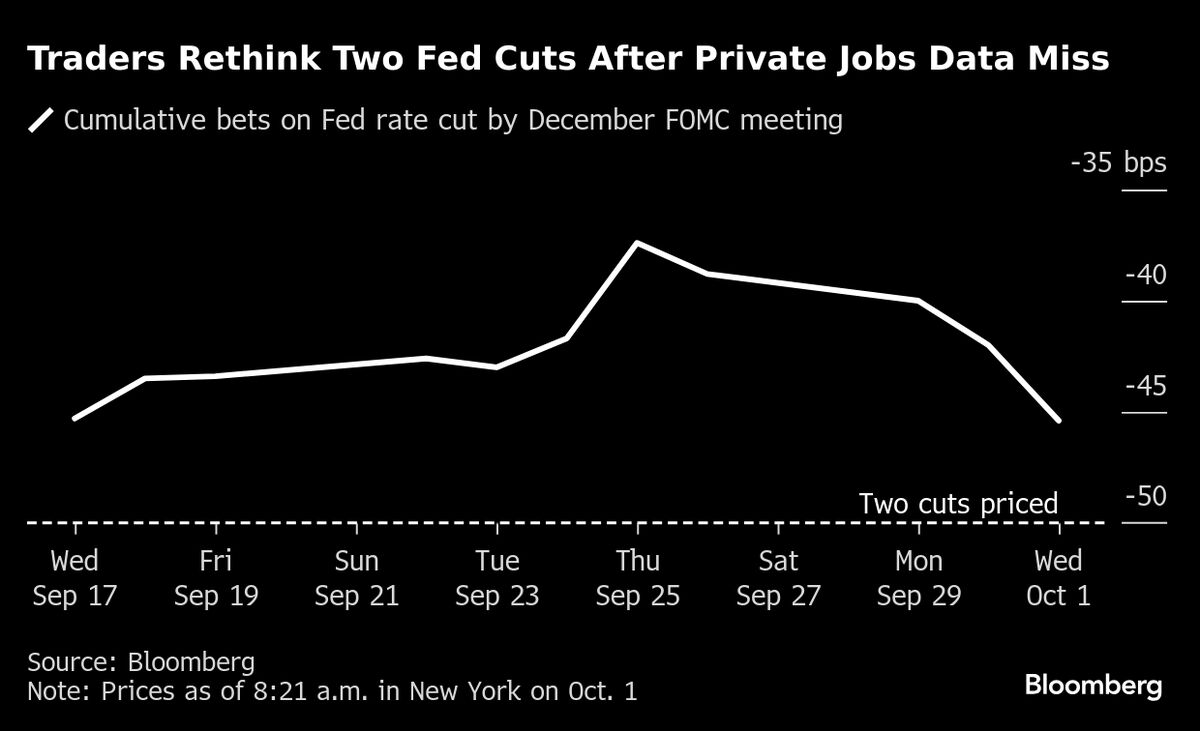

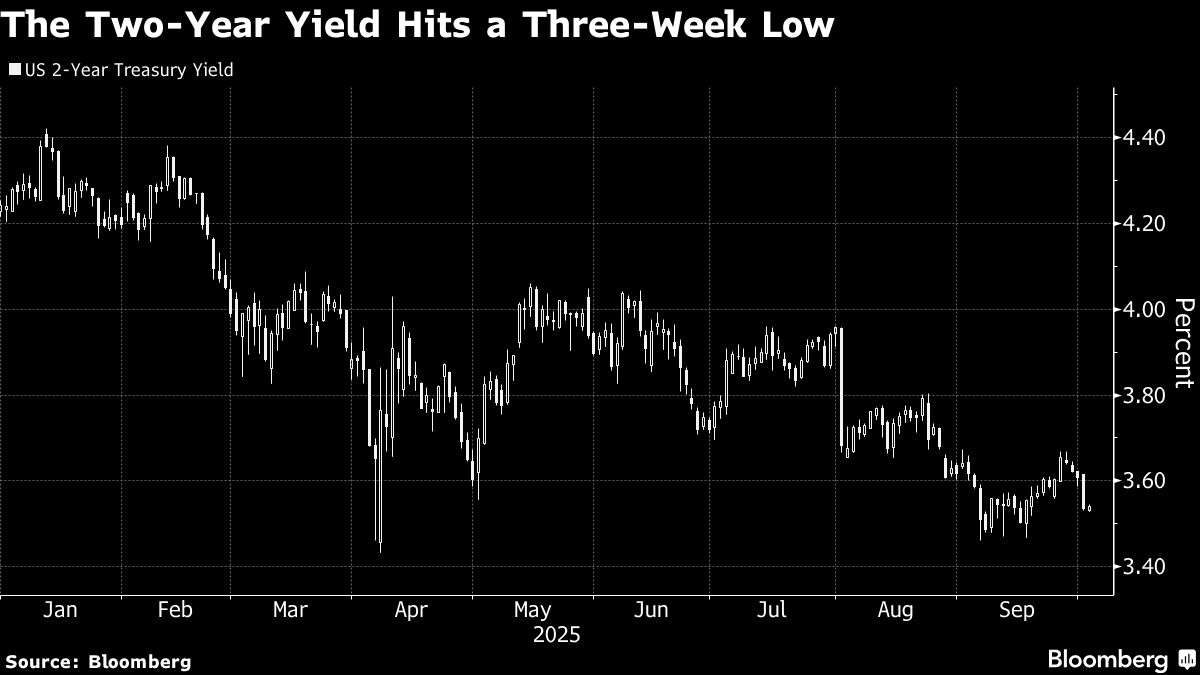

Treasuries Hold Gains After US Jobs Data Points to Fed Cut

PositiveFinancial Markets

Treasuries are maintaining their gains following the latest US jobs data, which has increased expectations for an interest-rate cut by the Federal Reserve this month. This is significant as it reflects the market's response to economic indicators, suggesting a potential easing of monetary policy that could stimulate growth.

— Curated by the World Pulse Now AI Editorial System