How do Surrey businesses feel about the Budget?

NeutralFinancial Markets

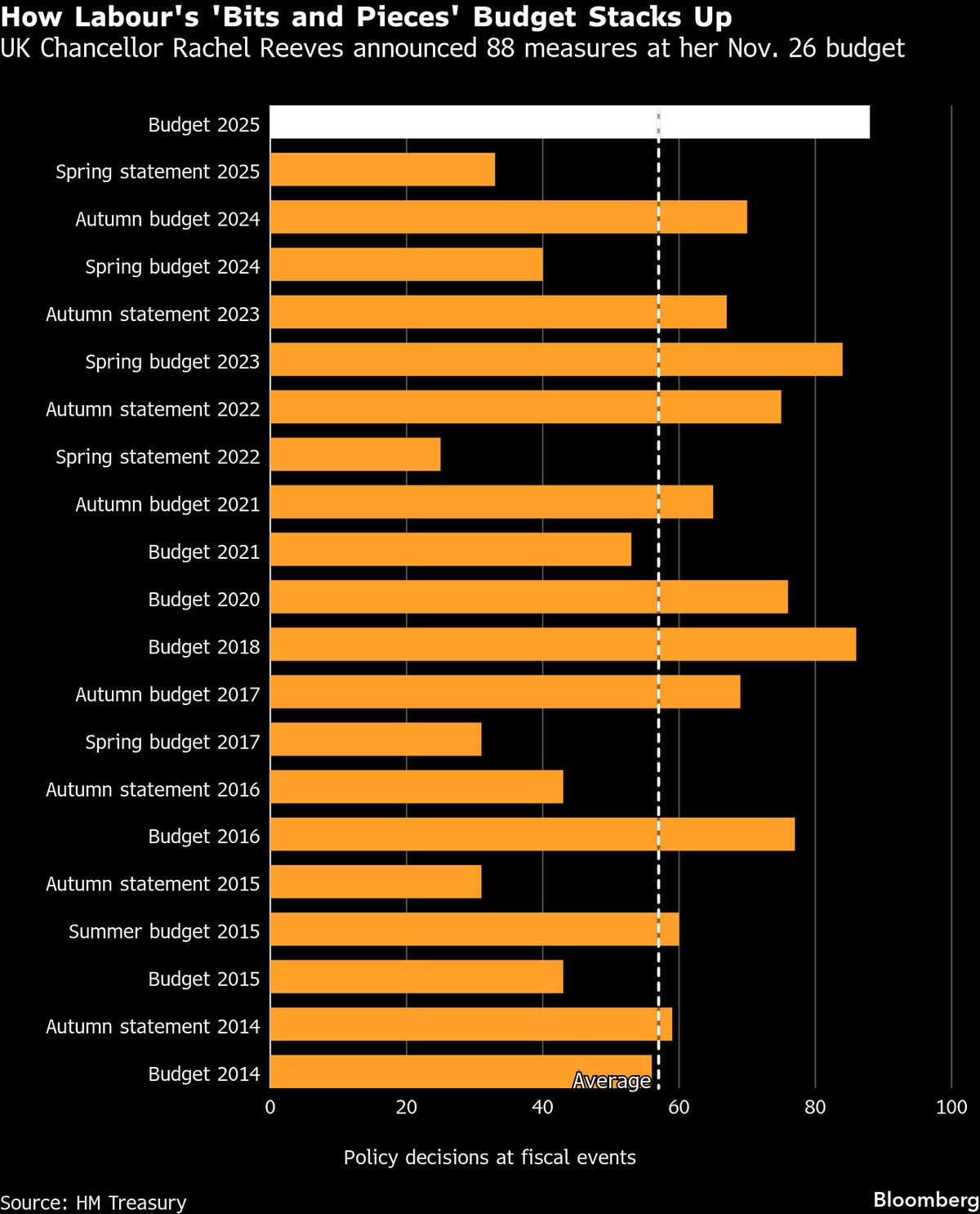

- Businesses in Surrey have expressed mixed reactions to Chancellor Rachel Reeves' recent Budget, which includes significant reforms aimed at addressing the ongoing cost of living crisis. The Budget features a £26 billion tax increase and changes to welfare policies, which have sparked varied responses from local enterprises.

- The reactions from Surrey businesses are crucial as they reflect the immediate impact of fiscal policies on local economies. Understanding these sentiments can provide insights into how businesses are adapting to new financial pressures and the potential implications for future investments and growth.

- This Budget is part of a broader narrative concerning economic stability in the UK, with ongoing debates about tax increases and welfare reforms. The mixed feedback from Surrey businesses highlights the challenges faced by local economies amid national fiscal changes, as stakeholders grapple with balancing economic recovery and fiscal responsibility.

— via World Pulse Now AI Editorial System