Rachel Reeves’s budget creates tax break for rich former non-doms

NegativeFinancial Markets

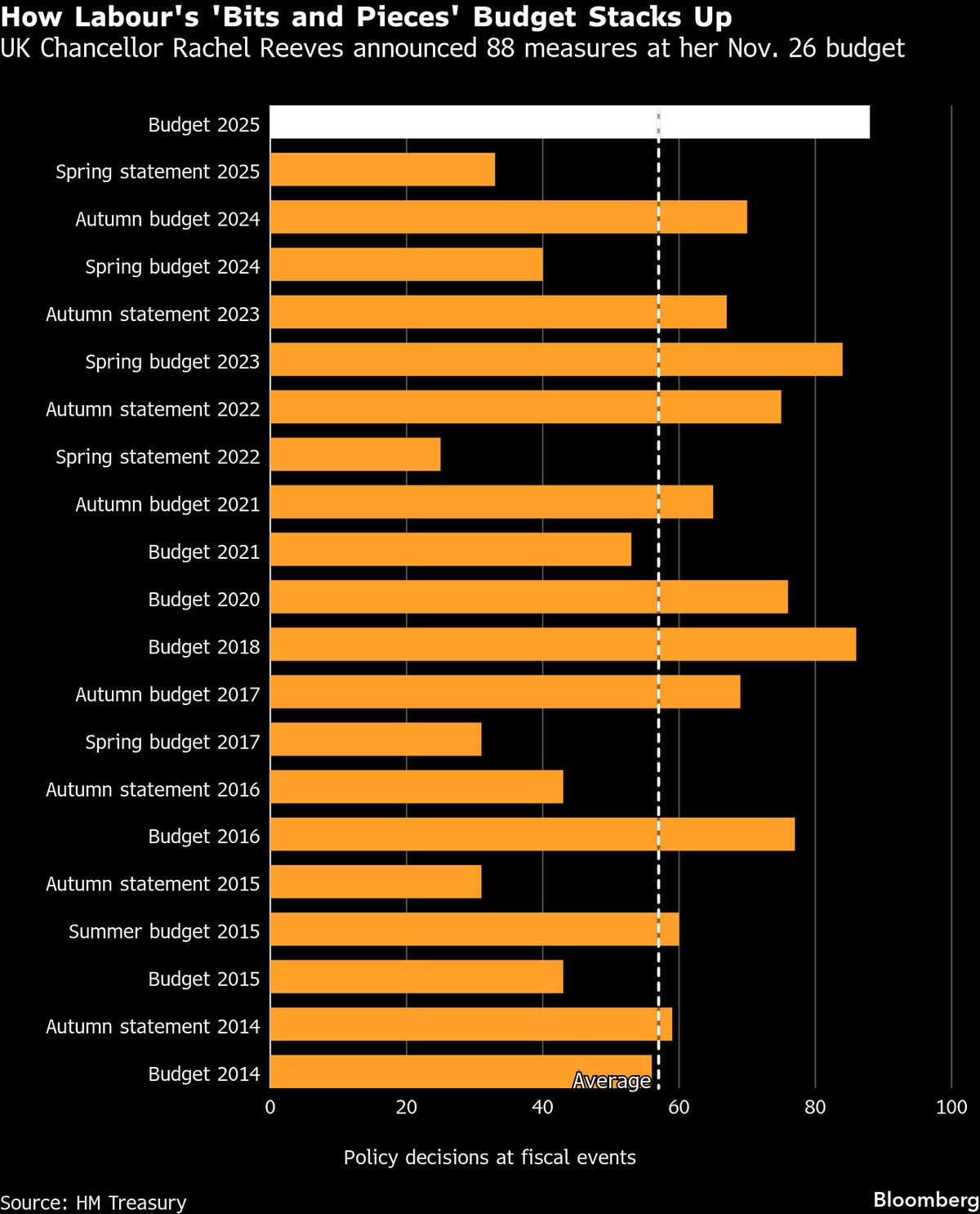

- Chancellor Rachel Reeves's recent budget includes a tax break for wealthy former non-domiciled individuals, significantly reducing their inheritance tax liabilities. Experts indicate that this benefit primarily favors those with assets exceeding £83 million, raising concerns about equity in tax policy.

- This development is critical as it highlights the government's approach to taxation amidst ongoing economic challenges, particularly the £26 billion tax increase aimed at stabilizing the economy while simultaneously providing benefits to the ultra-wealthy.

- The budget has sparked debate over its implications for ordinary taxpayers, who are expected to shoulder higher tax burdens, including a freeze on income tax thresholds and increased bills for savers and investors, reflecting a broader trend of fiscal policies that may disproportionately affect lower and middle-income households.

— via World Pulse Now AI Editorial System