Budget tax rises may be ‘fiscal fiction’ as pain delayed for election year, IFS warns

NegativeFinancial Markets

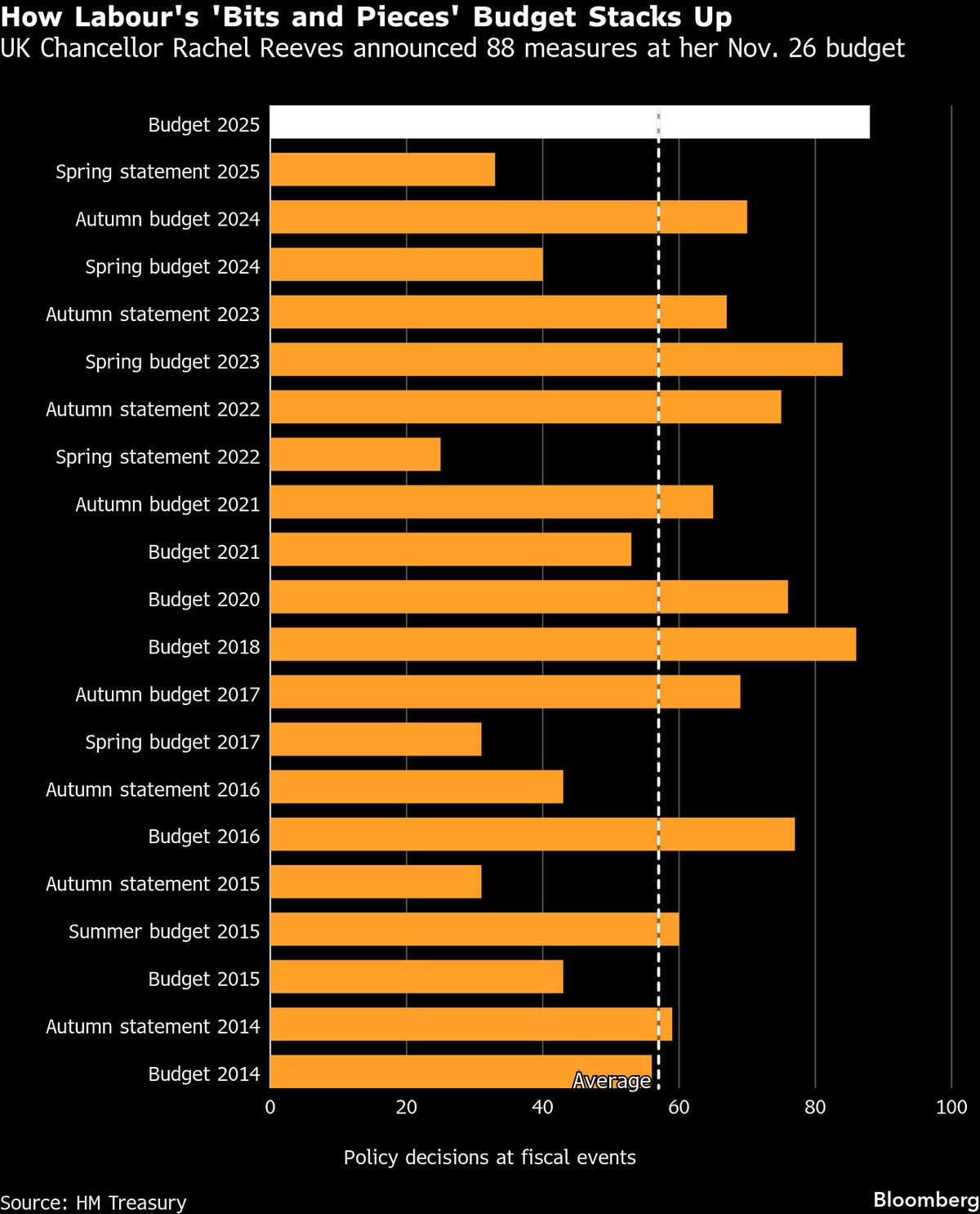

- Chancellor Rachel Reeves announced a budget that includes a £26 billion tax increase and the scrapping of the two-child benefit cap, aiming to address the UK's cost of living crisis. However, the Institute for Fiscal Studies (IFS) has warned that this strategy may be 'fiscal fiction', as it delays the financial impact until just before the next general election in 2029.

- The budget's significant tax increases are a critical concern for Labour MPs, who fear the financial burden on their constituents could lead to political repercussions. Reeves' approach is seen as high-risk, potentially alienating voters if the promised benefits do not materialize.

- This budget reflects ongoing tensions within the Labour Party as it navigates fiscal challenges while attempting to maintain support from its base. The pressure to balance tax increases with welfare spending highlights a broader debate on economic strategy, particularly as voters express dissatisfaction with centrist policies amid rising living costs.

— via World Pulse Now AI Editorial System