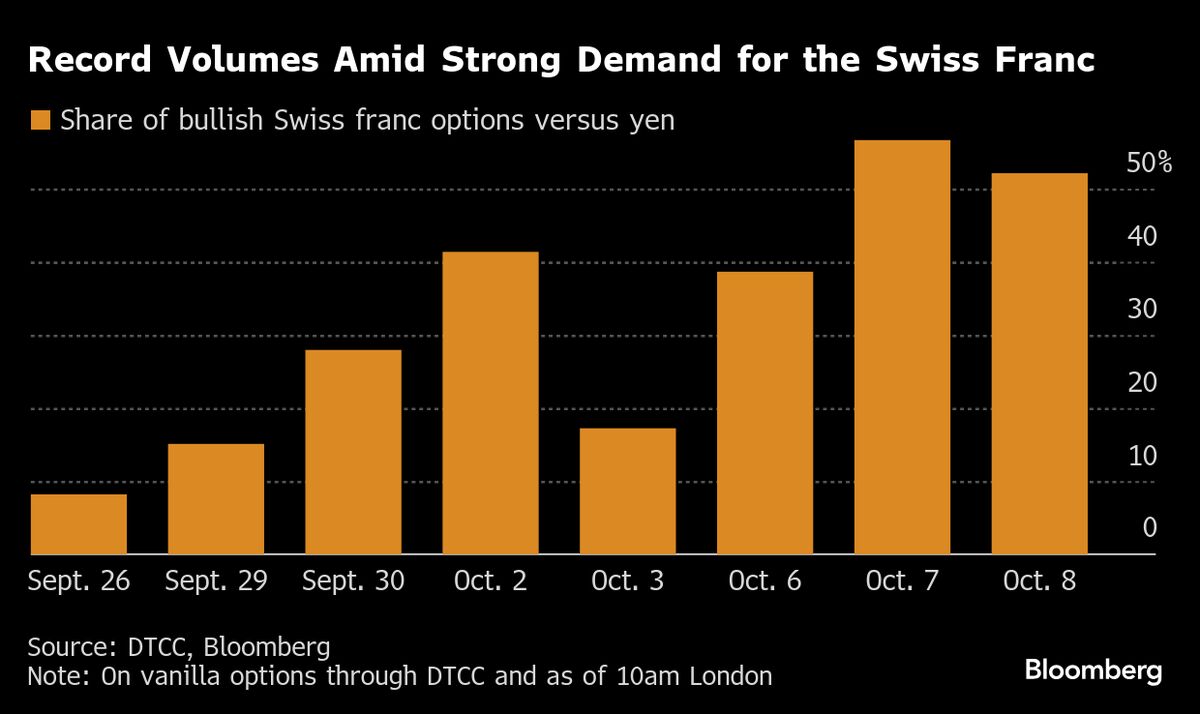

Japan’s Takaichi win weakens yen as markets eye intervention level

NegativeFinancial Markets

Japan's recent political developments, particularly the victory of Takaichi, have led to a weakening of the yen, raising concerns among investors about potential market interventions. This situation is significant as it reflects the ongoing volatility in currency markets and the impact of political changes on economic stability, prompting traders to closely monitor the government's response.

— Curated by the World Pulse Now AI Editorial System