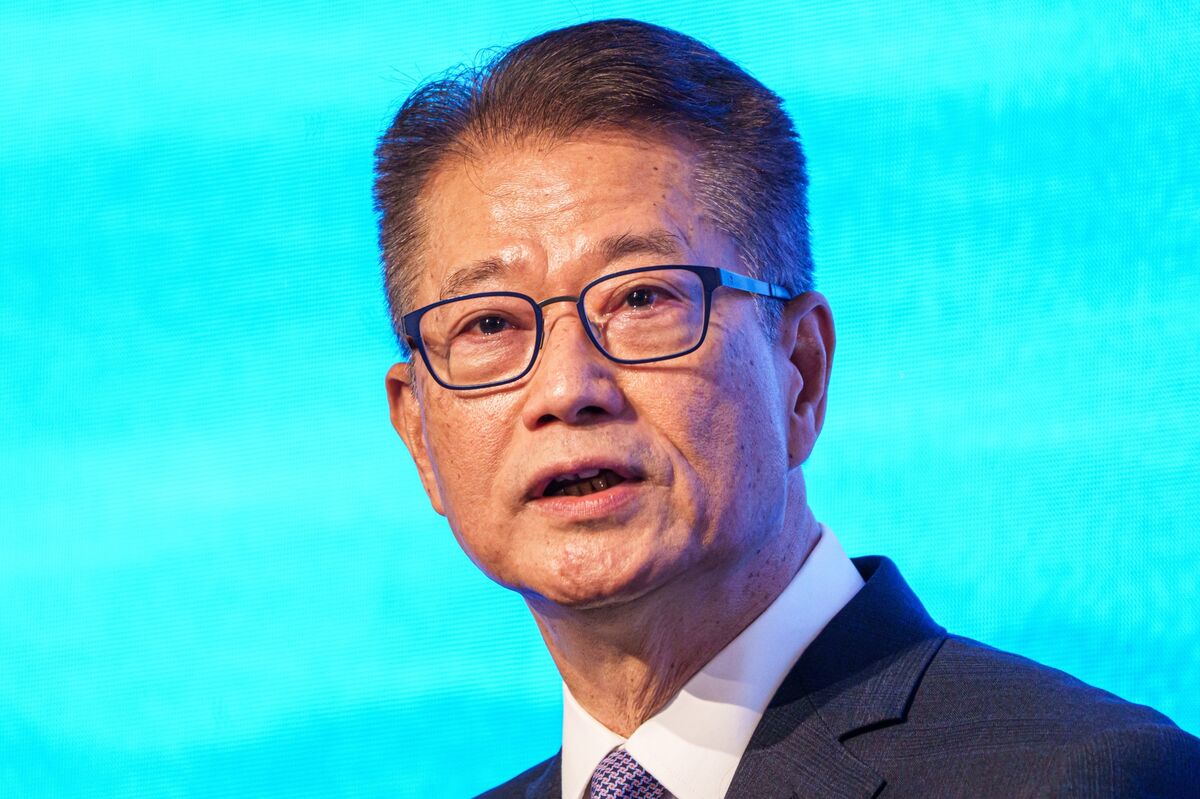

Hong Kong’s Financial Chief Says About 200 Firms Planning IPOs

PositiveFinancial Markets

Hong Kong's financial chief has announced that over 200 firms are preparing to launch initial public offerings (IPOs), signaling a robust year for stock sales in the region. This surge in IPO activity highlights the city's growing appeal as a financial hub and reflects investor confidence in the market, which is crucial for economic recovery and growth.

— Curated by the World Pulse Now AI Editorial System