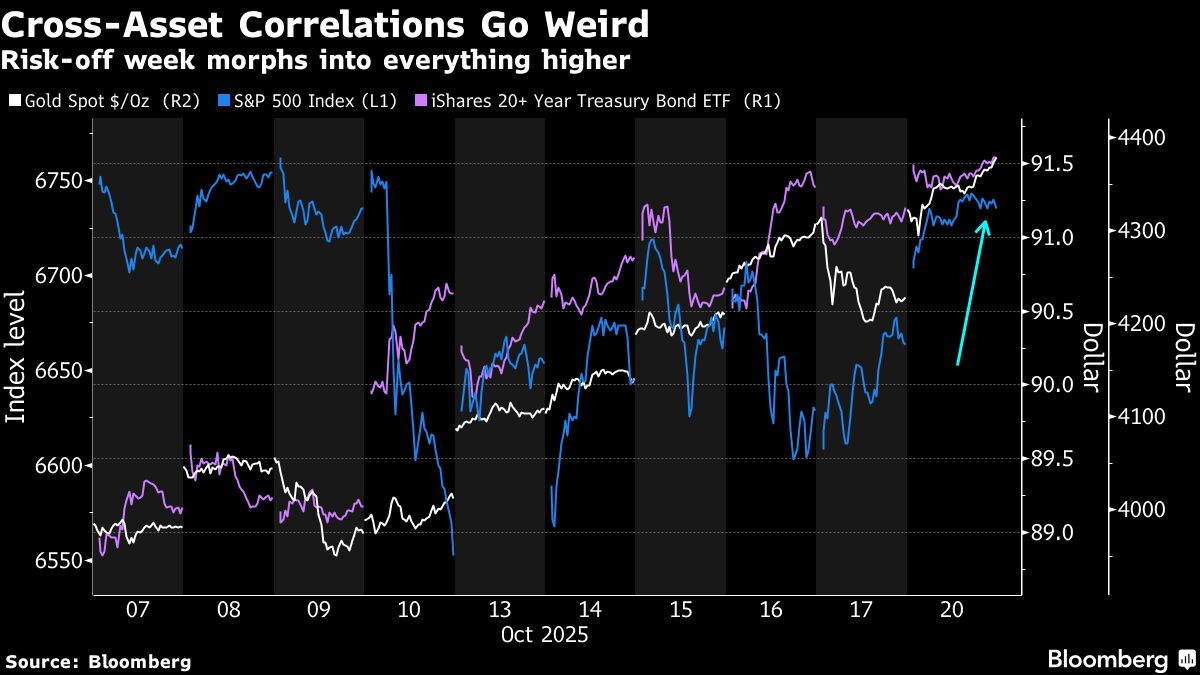

Goldman’s Molavi Says Asset Class Correlation Is Looking Weird

NeutralFinancial Markets

Goldman's Molavi has pointed out that asset classes are behaving unusually in relation to each other, creating confusion among even the most experienced equity market traders. This observation is significant as it highlights potential shifts in market dynamics that could impact investment strategies.

— Curated by the World Pulse Now AI Editorial System