UK investors quit equity funds at record pace as they flee sky-high stock markets – business live

NegativeFinancial Markets

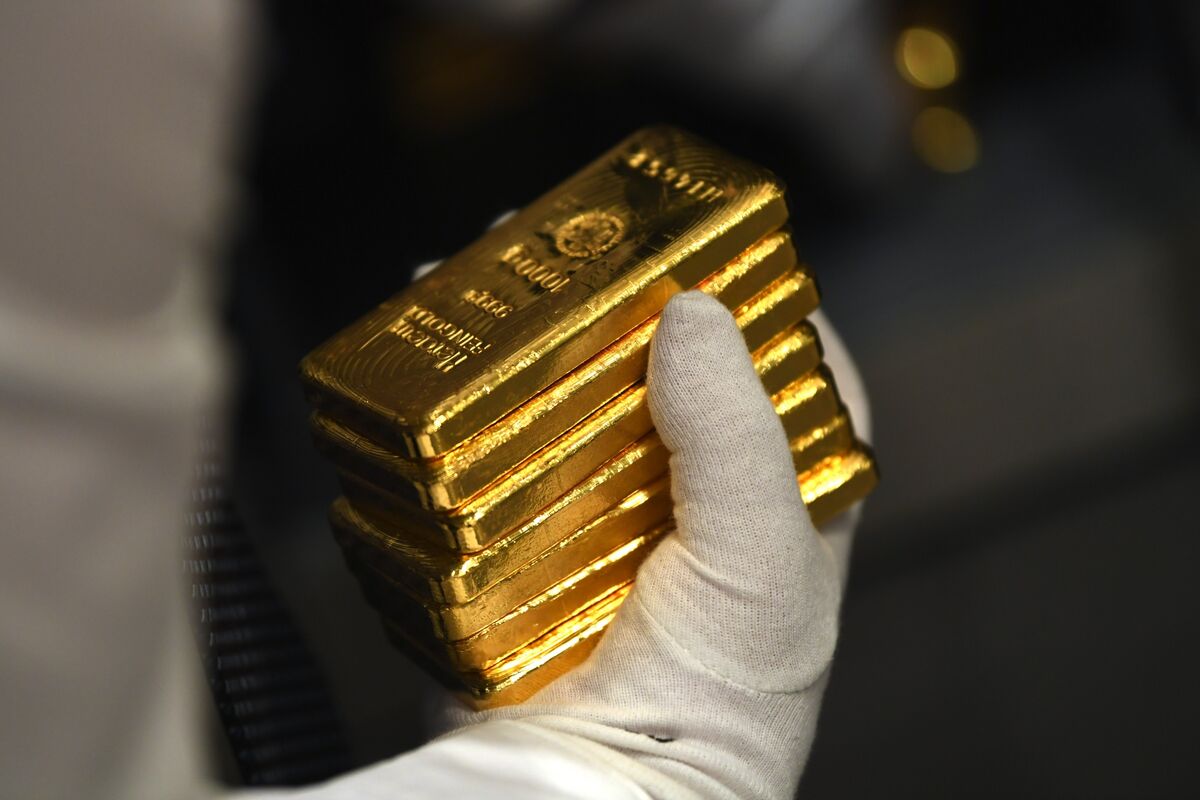

UK investors are pulling out of equity funds at an unprecedented rate, as reported by Calastone, indicating a significant shift in market sentiment amidst soaring stock prices. This trend highlights growing concerns among investors about the sustainability of current market valuations. Meanwhile, Goldman Sachs has raised its gold price forecast, predicting it will reach $4,900 per ounce by December 2026, reflecting a potential safe haven for investors amid market volatility. This situation underscores the cautious approach many are taking in the face of economic uncertainty.

— Curated by the World Pulse Now AI Editorial System