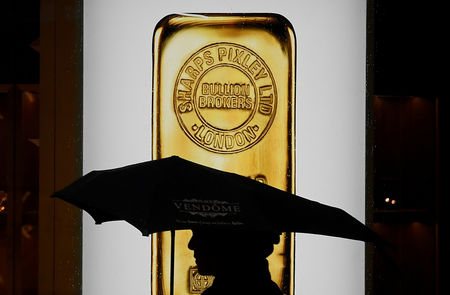

Big Risks Facing Gold's Rally To $4,000 And Beyond | Insight with Haslinda Amin 10/7/2025

NeutralFinancial Markets

In a recent episode of 'Insight with Haslinda Amin,' the discussion centered around the potential risks that could impact gold's rally towards $4,000. The program, known for its in-depth interviews and analysis, highlights the significance of understanding market dynamics, especially in the realms of finance and politics. This matters because gold is often seen as a safe haven during economic uncertainty, and fluctuations in its value can have widespread implications for investors and the global economy.

— Curated by the World Pulse Now AI Editorial System