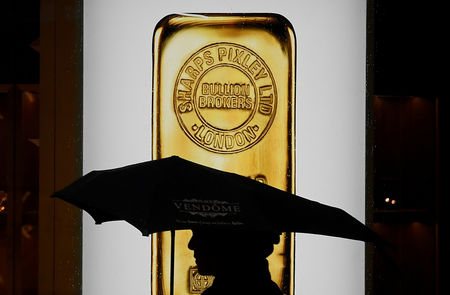

Gold prices hit record highs near $4,000/oz amid global political uncertainty

PositiveFinancial Markets

Gold prices have surged to record highs nearing $4,000 per ounce, driven by rising global political uncertainty. This spike is significant as it reflects investors' growing demand for safe-haven assets amid economic instability, making gold a key player in financial markets. Such trends can influence investment strategies and economic forecasts, highlighting the importance of gold in times of crisis.

— Curated by the World Pulse Now AI Editorial System