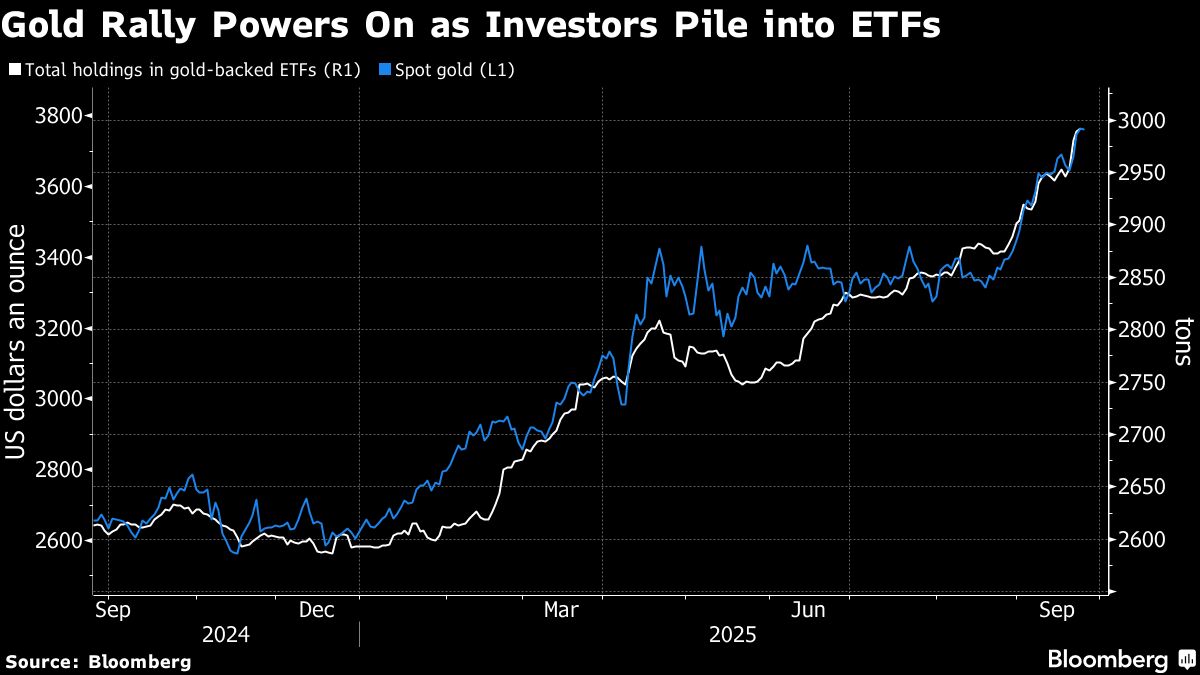

Trading Day: Tech euphoria cools, gold still sizzling

NeutralFinancial Markets

In today's trading day, the excitement surrounding tech stocks appears to be cooling off, while gold continues to attract attention from investors. This shift in market sentiment is significant as it reflects changing investor priorities and could indicate a broader trend in asset allocation. Understanding these dynamics is crucial for anyone looking to navigate the current financial landscape.

— Curated by the World Pulse Now AI Editorial System