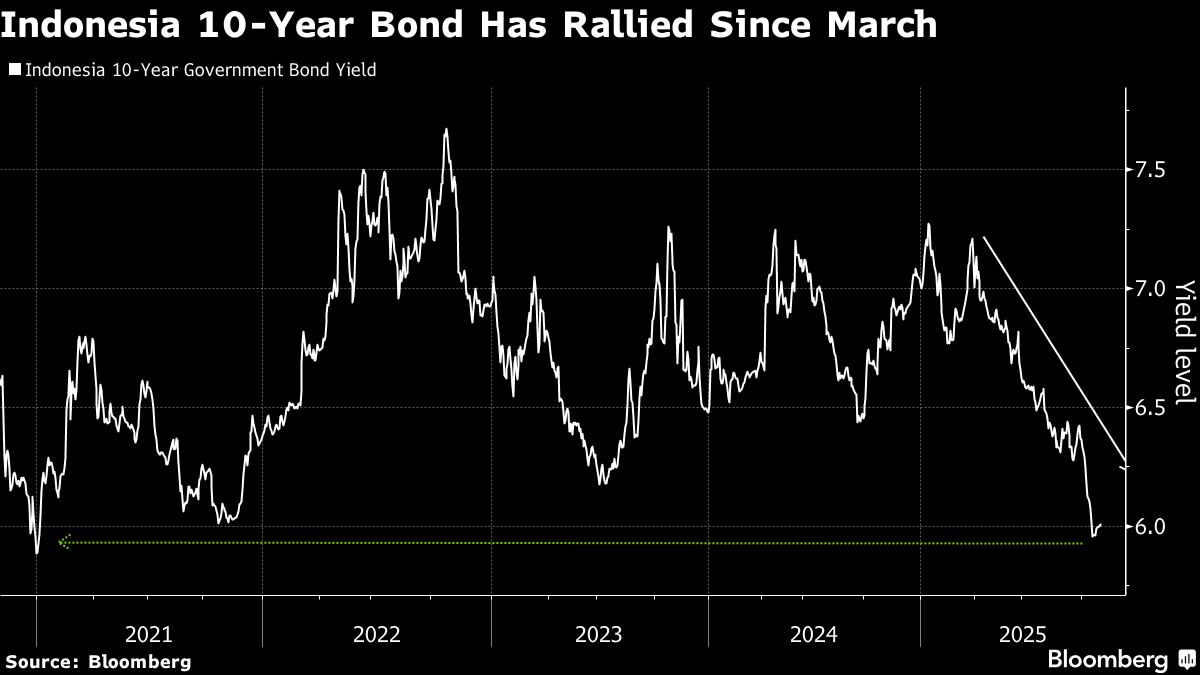

Indonesian Bonds Seen Extending Rally on Rate-Cut Expectations

PositiveFinancial Markets

Indonesian bonds are expected to continue their upward trend as strategists anticipate further interest-rate cuts by the central bank. This is significant because lower rates can boost investor confidence and stimulate economic growth, making bonds more attractive to buyers.

— Curated by the World Pulse Now AI Editorial System