Sanctioned Russian Oil Will Find New Ways to Flow

NeutralFinancial Markets

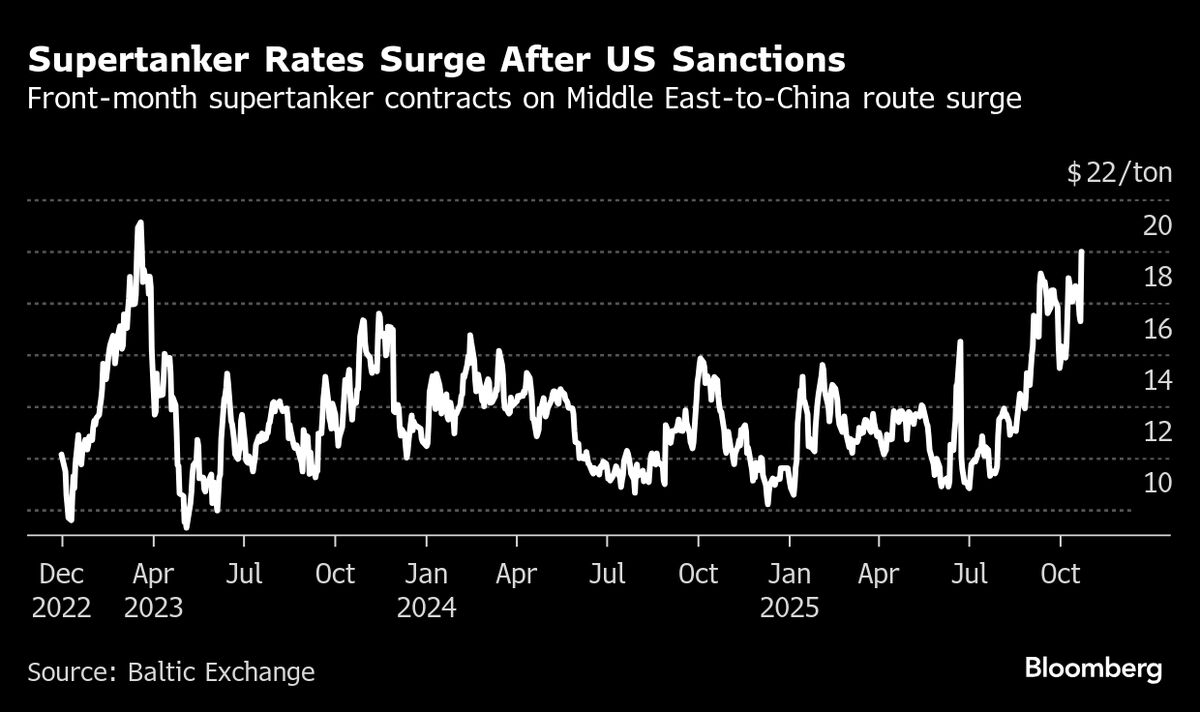

The recent U.S. restrictions on Russian oil are prompting the emergence of a parallel market that will adapt to these sanctions. This shift is significant as it highlights the resilience of global oil trade and the lengths to which countries will go to circumvent economic barriers. Understanding these developments is crucial for grasping the evolving dynamics of international energy markets.

— Curated by the World Pulse Now AI Editorial System