Sanctioned Russian Oil Will Find New Ways to Flow

NeutralFinancial Markets

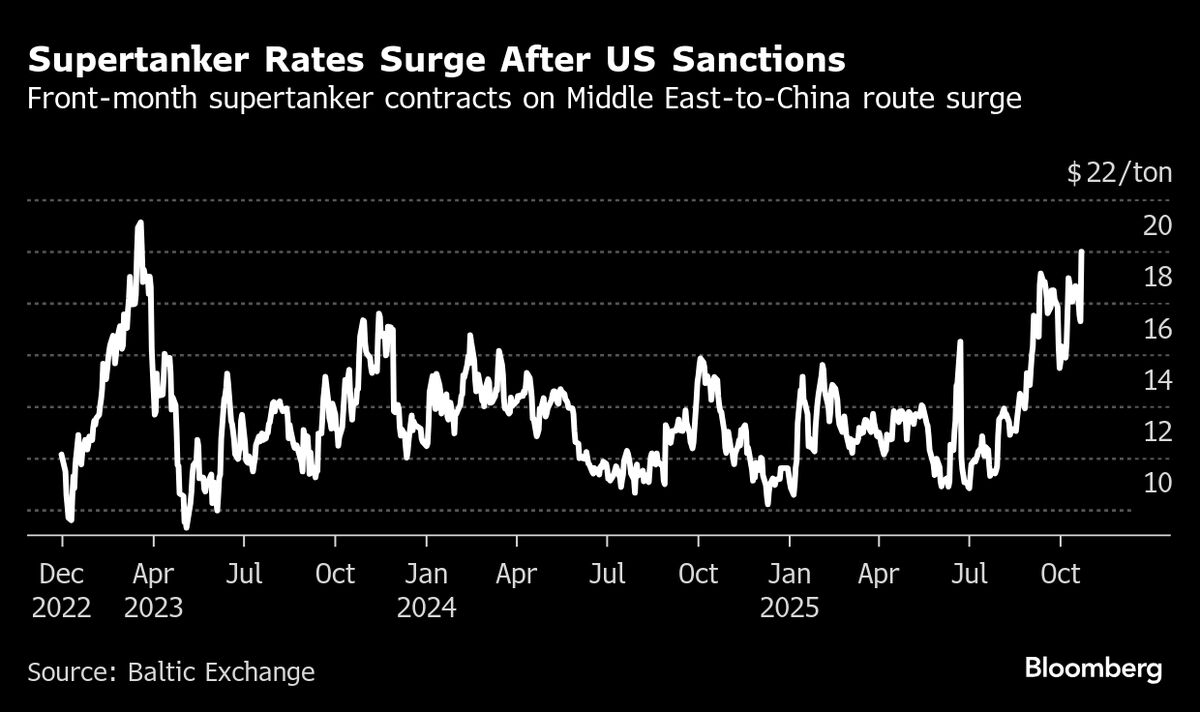

The recent U.S. restrictions on Russian oil are prompting the emergence of a parallel market that will adapt to these sanctions. This shift is significant as it highlights the resilience of global oil trade and the lengths to which countries will go to circumvent restrictions. Understanding these dynamics is crucial for stakeholders in the energy sector and policymakers alike.

— Curated by the World Pulse Now AI Editorial System