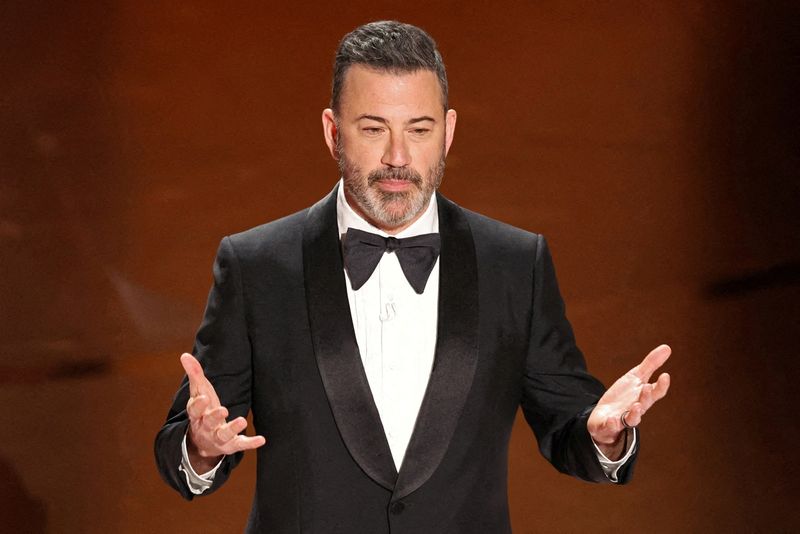

Behind the fall and resurrection of Jimmy Kimmel is a $6.2 billion merger and the pro-Republican companies that serve rural, conservative audiences

NeutralFinancial Markets

The recent developments surrounding Jimmy Kimmel highlight the complex landscape of the television industry, particularly with the pressures from the FCC and significant mergers totaling $6.2 billion. This situation underscores the shifting dynamics of linear TV, which is increasingly influenced by pro-Republican companies targeting rural and conservative audiences. As the future of traditional television hangs in the balance, these factors could reshape how content is produced and consumed.

— Curated by the World Pulse Now AI Editorial System