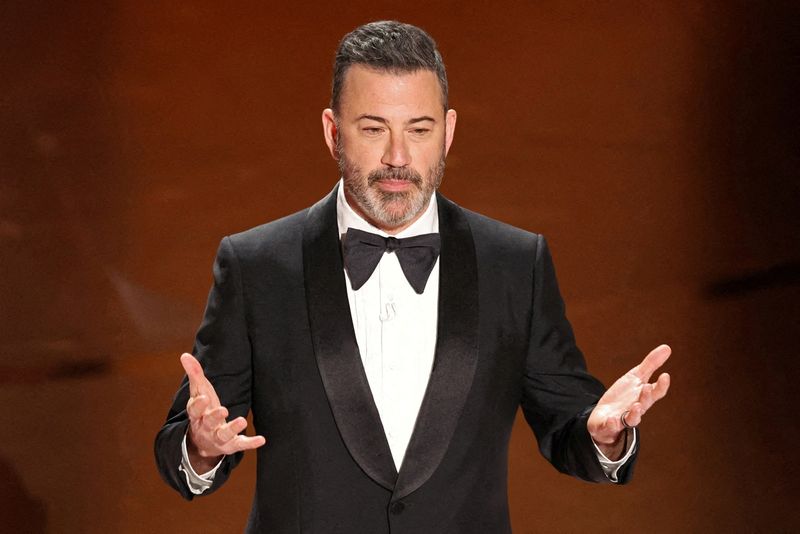

What’s Behind Nexstar and Sinclair Boycotting Jimmy Kimmel?

NegativeFinancial Markets

Nexstar and Sinclair's boycott of Jimmy Kimmel stems from controversial remarks he made about Charlie Kirk, leading to his show's suspension. This situation highlights the tension between media personalities and corporate interests, especially as both companies seek new deals for their local TV networks. The protest outside Disneyland reflects public sentiment and raises questions about freedom of speech in entertainment.

— Curated by the World Pulse Now AI Editorial System