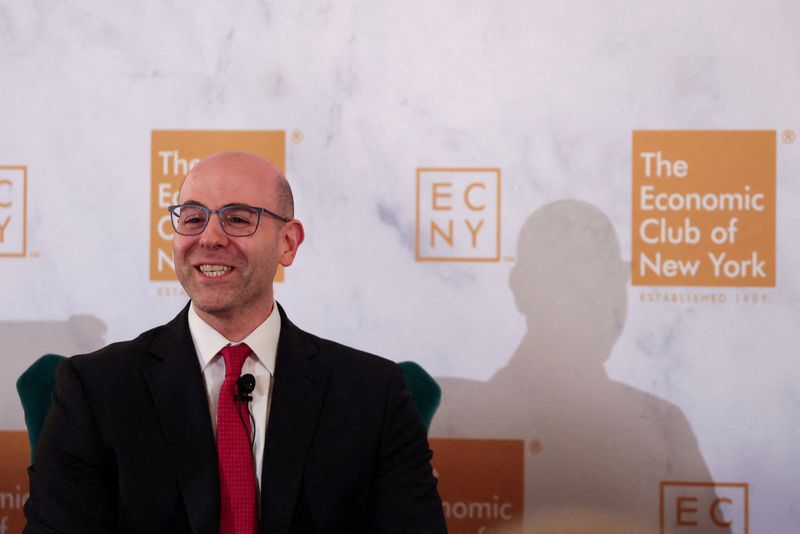

Morgan Stanley’s Wilson Sees Need for 150 Bps of Fed Rate Cuts

PositiveFinancial Markets

Mike Wilson from Morgan Stanley believes that the Federal Reserve needs to cut interest rates by 150 basis points to catch up with the current economic recovery in the US. He argues that the Fed is lagging behind, which could hinder the ongoing recovery. This perspective is significant as it highlights the potential for more favorable economic conditions if the Fed adjusts its policies accordingly.

— Curated by the World Pulse Now AI Editorial System