Rare-Earth Magnet Startups Seal $1.4 Billion Deal With Trump Administration

PositiveFinancial Markets

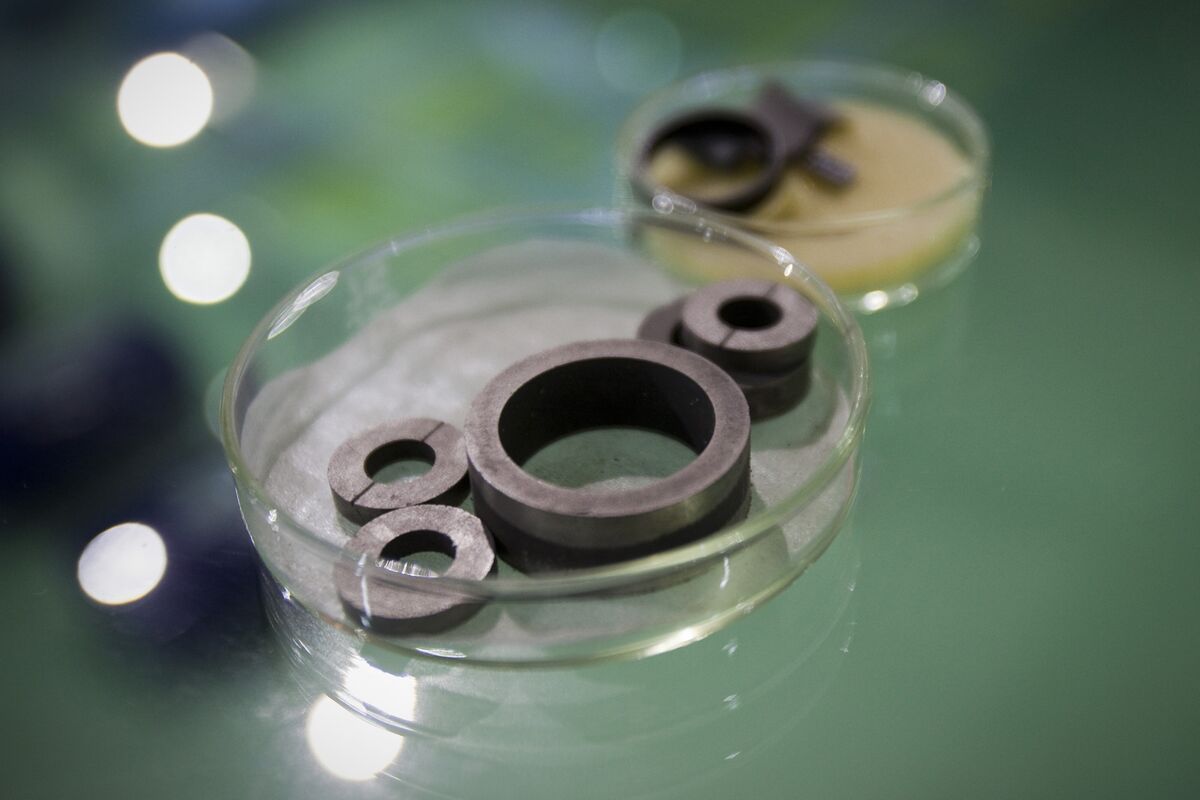

A significant $1.4 billion deal between the Trump administration and rare-earth magnet startups Vulcan Elements and ReElement Technologies signals a strong commitment from the Pentagon to establish a domestic supply chain. This move is crucial as it aims to reduce reliance on China, which currently dominates the rare-earth materials market. By investing in these startups, the U.S. is taking steps to secure its technological and defense industries, ensuring greater independence and stability in critical supply chains.

— Curated by the World Pulse Now AI Editorial System