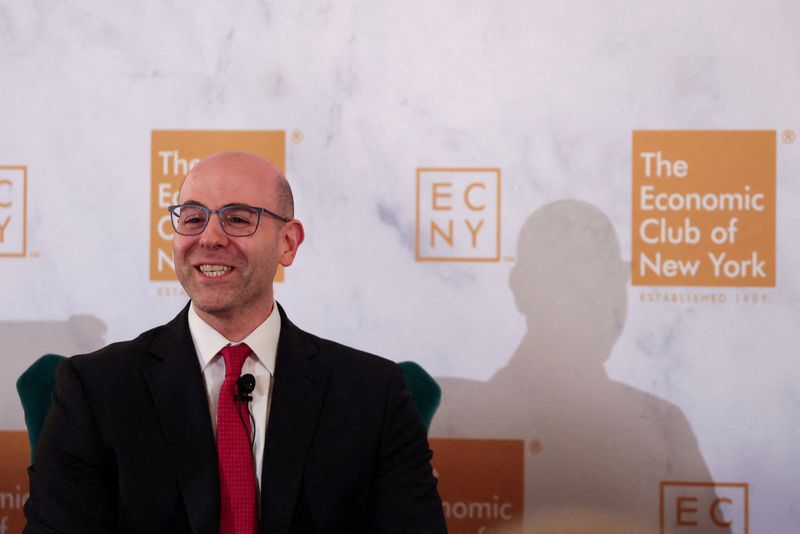

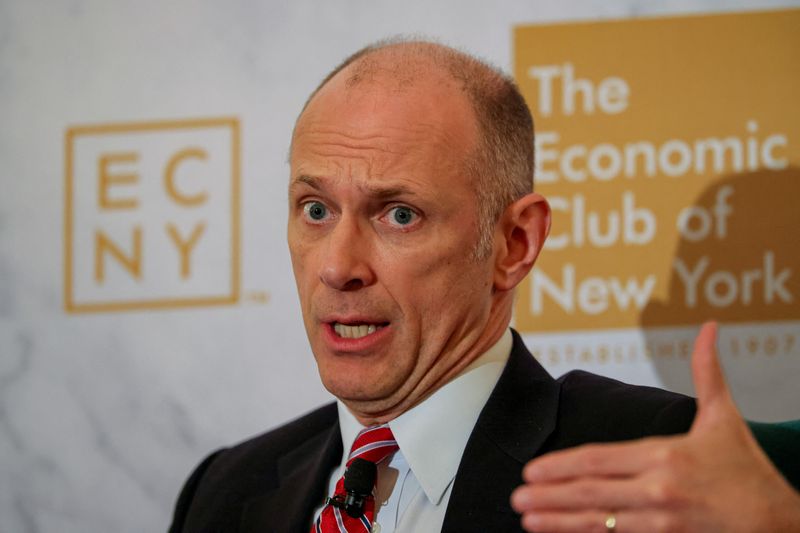

Fed’s Goolsbee hesitant on December rate cut amid inflation concerns

NeutralFinancial Markets

Federal Reserve official Austan Goolsbee expressed caution regarding a potential interest rate cut in December, citing ongoing inflation concerns. This statement is significant as it reflects the Fed's careful approach to monetary policy amidst fluctuating economic indicators. Investors and economists will be closely monitoring these developments, as they could impact borrowing costs and overall economic growth.

— Curated by the World Pulse Now AI Editorial System