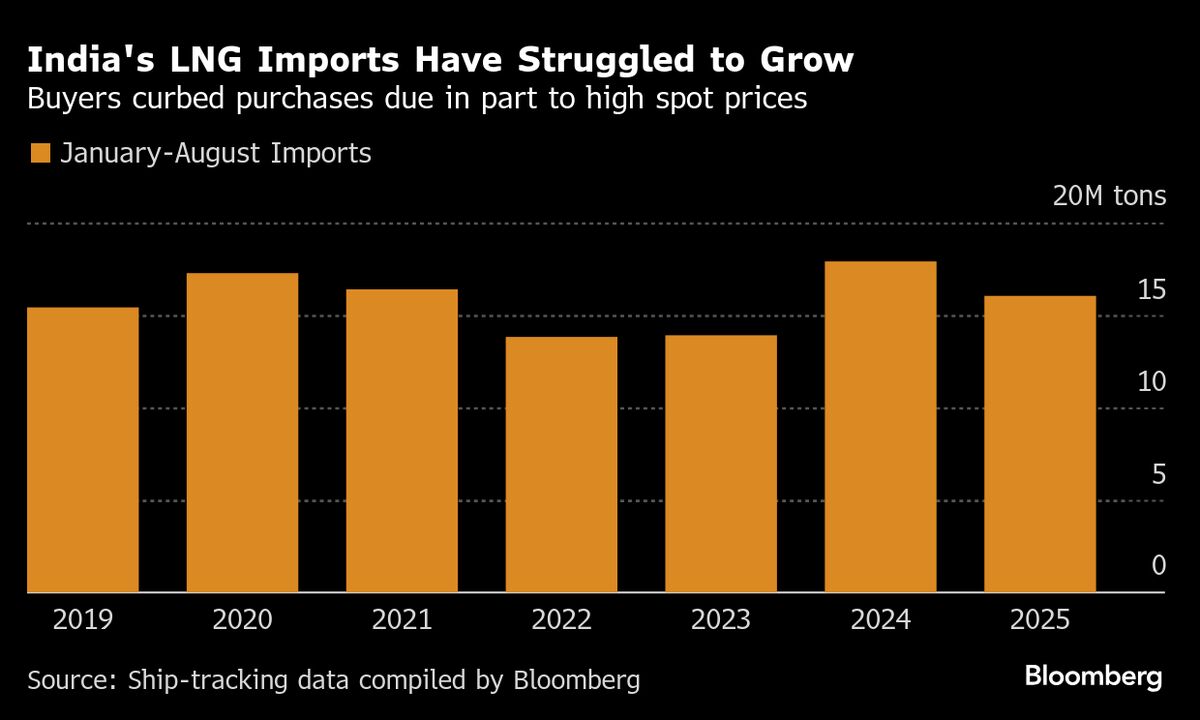

Cheap Chinese Coal is Making it Difficult to Reduce Consumption

NegativeFinancial Markets

Chinese coal prices are expected to decline as 2025 approaches, complicating efforts to reduce coal consumption and meet climate targets.

Editor’s Note: This situation is significant because it highlights the challenges in transitioning to cleaner energy sources. As coal remains cheap, it undermines initiatives aimed at reducing carbon emissions and achieving climate goals.

— Curated by the World Pulse Now AI Editorial System