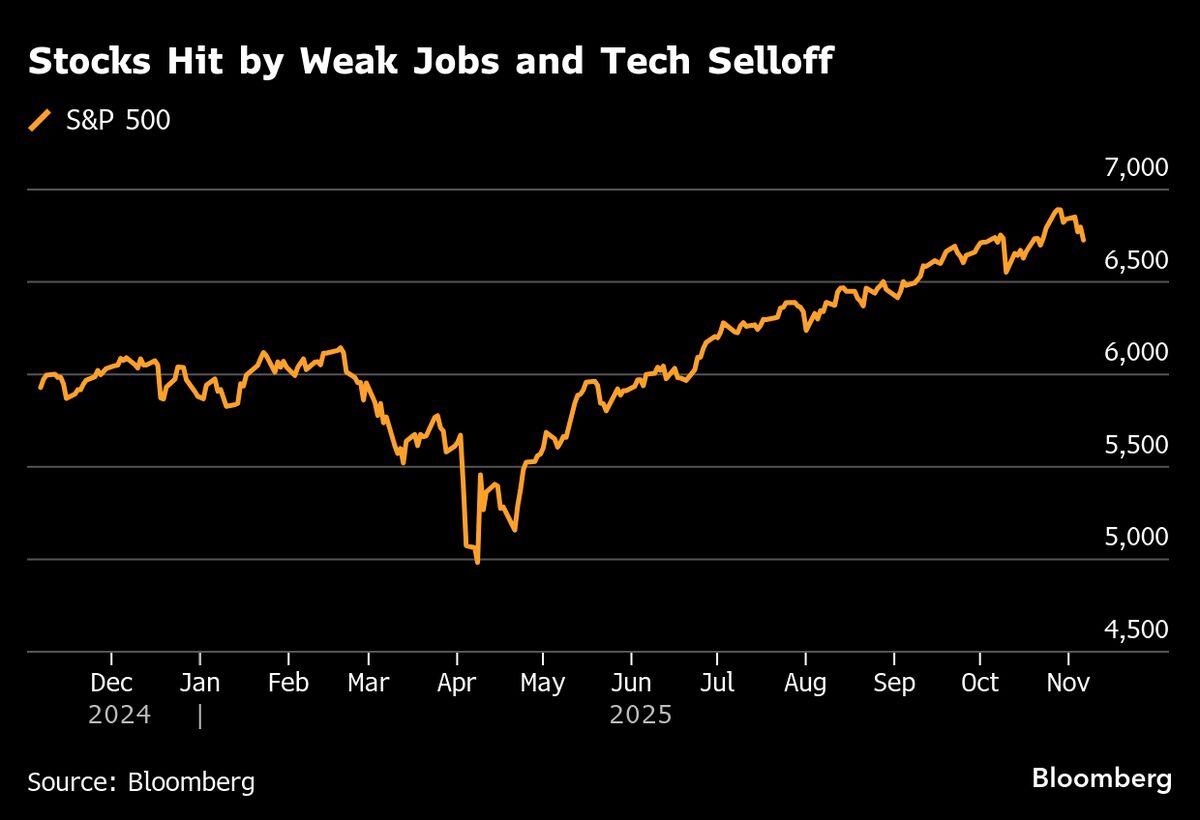

US Companies Announce Most October Job Cuts in Over 20 Years

NegativeFinancial Markets

US Companies Announce Most October Job Cuts in Over 20 Years

In a concerning trend, US companies reported the highest number of job cuts for any October in over 20 years, with a staggering 153,074 layoffs announced last month. This surge, nearly three times the cuts from the same month last year, highlights the significant impact of artificial intelligence and cost-cutting measures reshaping industries, particularly in technology and warehousing. This situation is alarming as it reflects broader economic challenges and raises questions about job security in an evolving job market.

— via World Pulse Now AI Editorial System