Asian Stocks to Decline After Volatile US Session: Markets Wrap

NegativeFinancial Markets

Asian Stocks to Decline After Volatile US Session: Markets Wrap

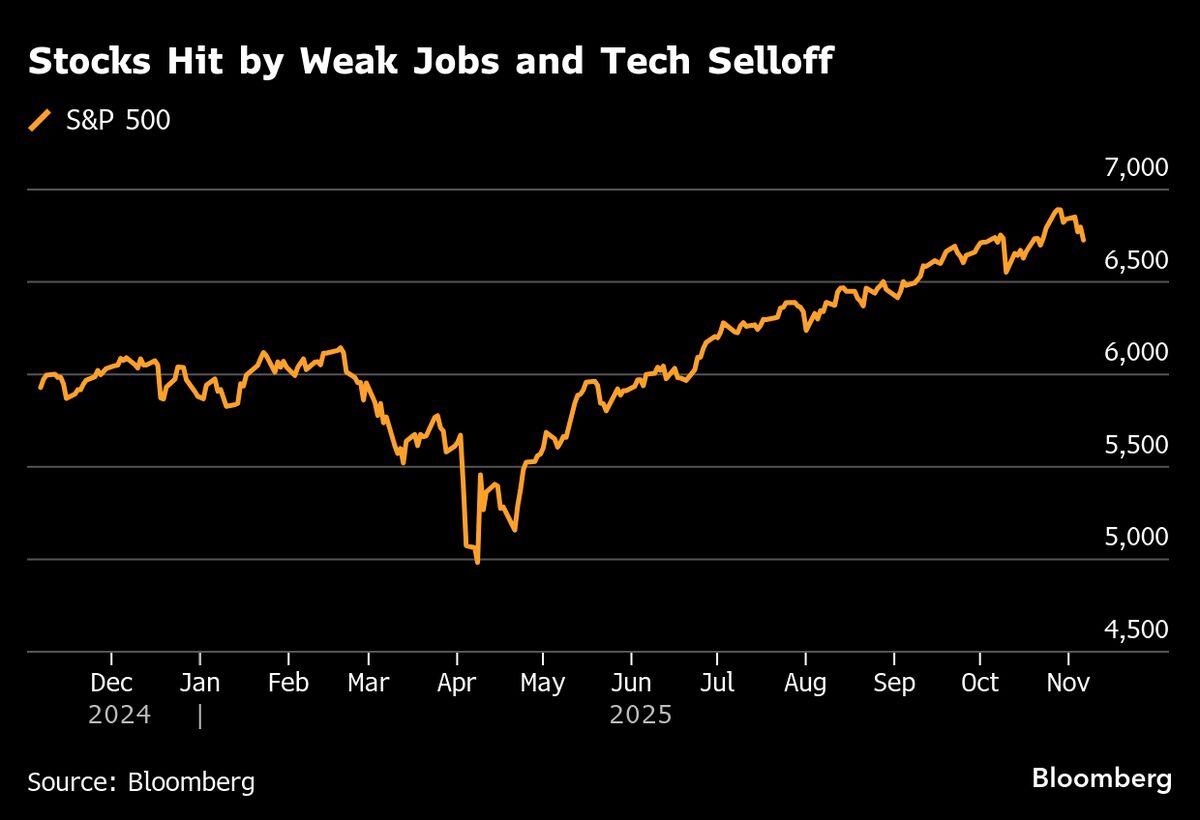

Asian stocks are expected to decline following a turbulent session on Wall Street, driven by worries about inflated valuations in the artificial intelligence sector and indications of a slowing labor market. This matters because it reflects broader economic concerns that could impact investor confidence and market stability.

— via World Pulse Now AI Editorial System