Miran Says Fed Policy Should Be Forward Looking

PositiveFinancial Markets

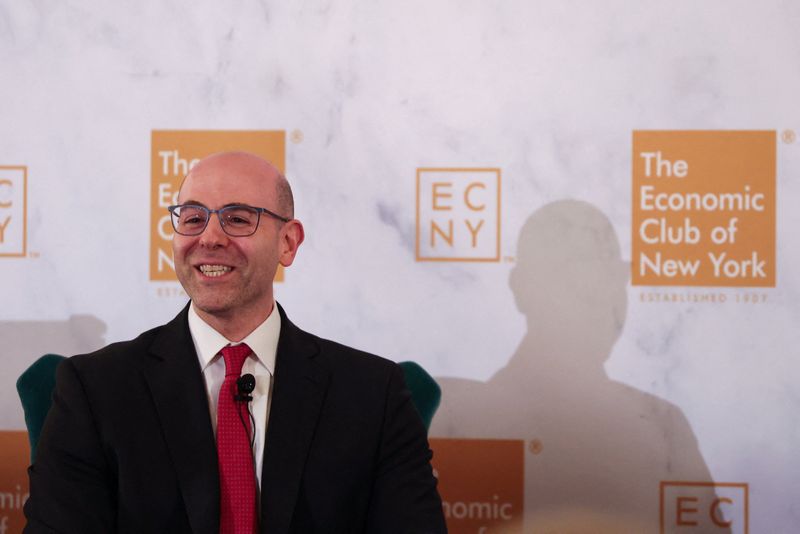

Federal Reserve Governor Stephen Miran recently shared his optimistic perspective on inflation during the MFA Policy Outlook 2025 event in New York, highlighting the housing market as a key factor. His views stand out among his colleagues, suggesting a more forward-looking approach to monetary policy. This matters because it could influence future economic strategies and reassure markets about the Fed's direction.

— Curated by the World Pulse Now AI Editorial System