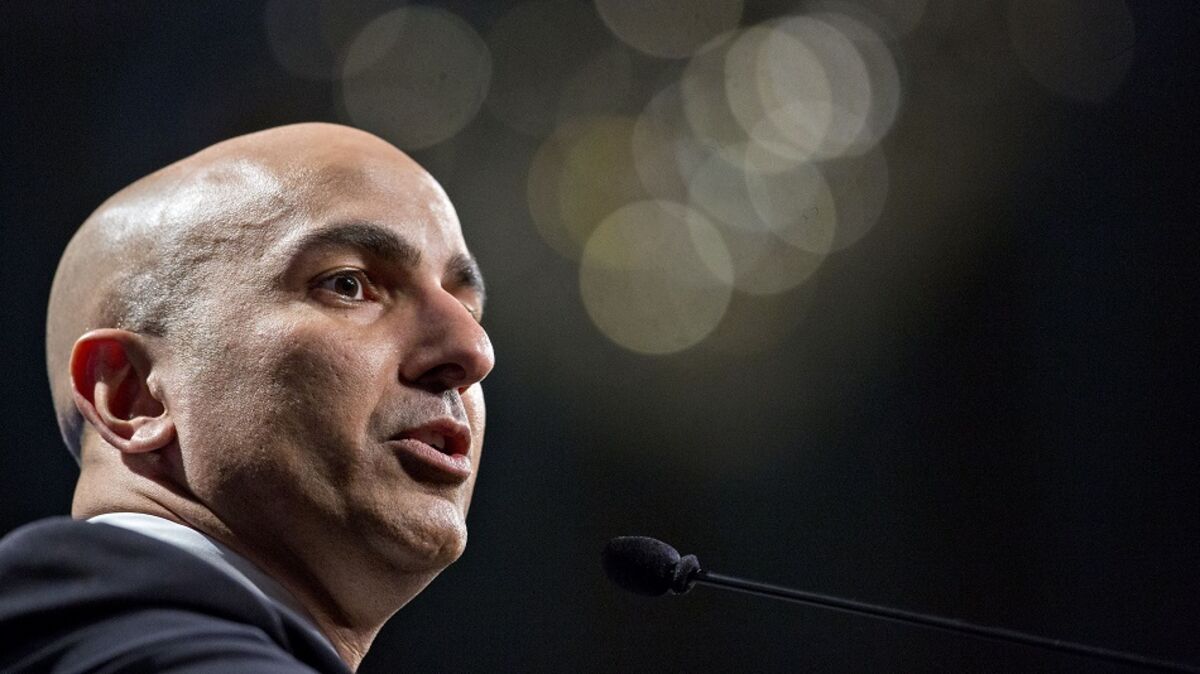

Fed’s Kashkari Warns Drastic Rate Cuts Would Stoke Inflation

NegativeFinancial Markets

Neel Kashkari, the President of the Federal Reserve Bank of Minneapolis, has raised concerns about the potential consequences of drastic interest rate cuts, warning that such actions could lead to increased inflation. This is significant as it highlights the delicate balance the Federal Reserve must maintain in managing economic growth while keeping inflation in check.

— Curated by the World Pulse Now AI Editorial System