European firms still can’t easily get Chinese rare earths, says business lobby

NegativeFinancial Markets

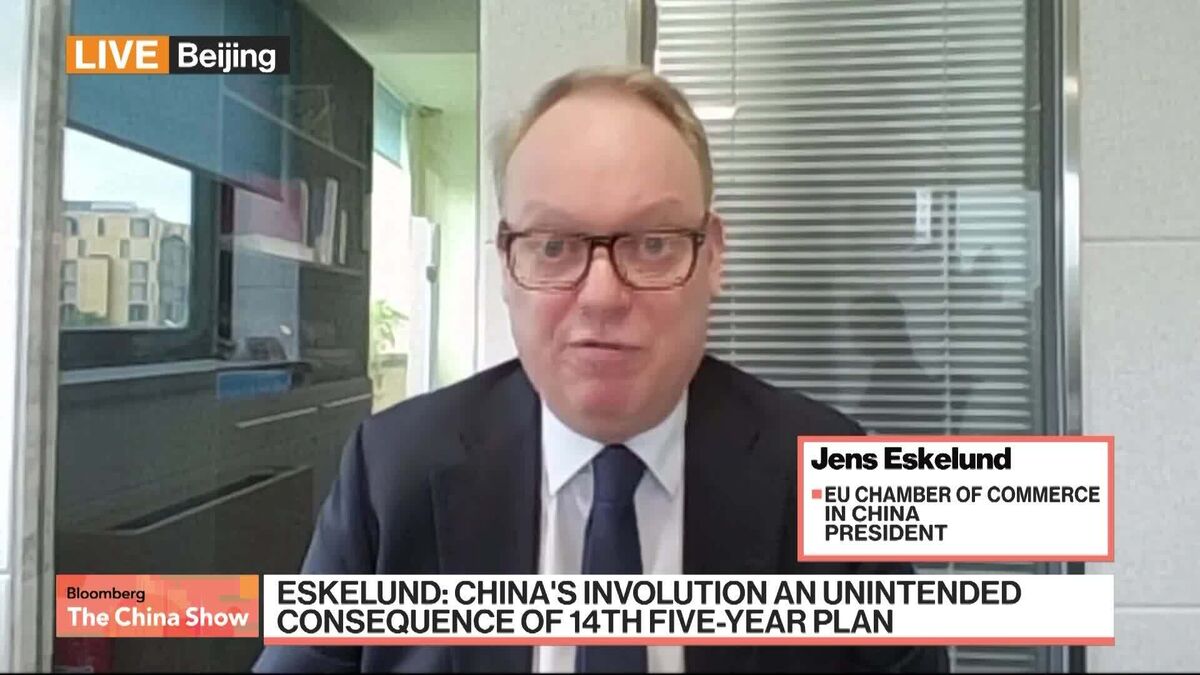

The European Union Chamber of Commerce in China has highlighted ongoing challenges for European companies in accessing Chinese rare earths, citing significant supply chain disruptions. This situation is concerning as rare earths are crucial for various industries, including technology and renewable energy. The difficulties in securing these materials could hinder the competitiveness of European firms and impact their ability to innovate and grow.

— Curated by the World Pulse Now AI Editorial System