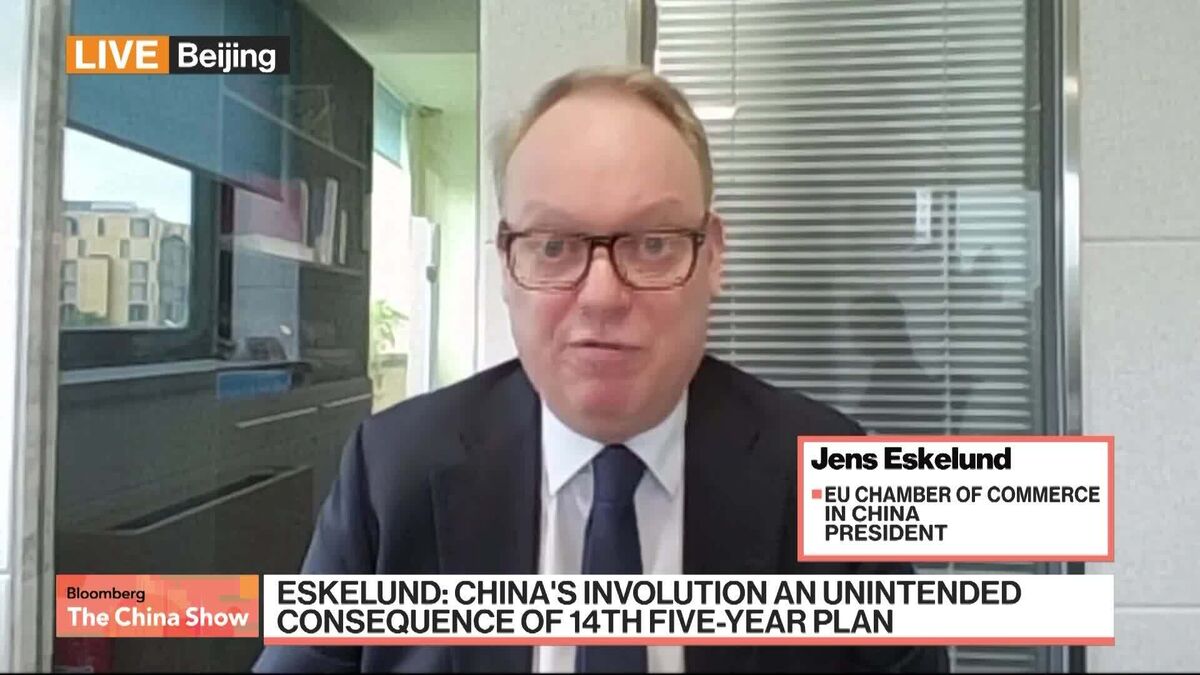

EU Business Group Calls for Fair China Trade Ties

PositiveFinancial Markets

Jens Eskelund, the President of the European Union Chamber of Commerce in China, recently highlighted the group's proposal for a fair trade relationship with China as the country outlines its development plan for the next five years. This discussion, featured on 'Bloomberg: The China Show,' emphasizes the importance of balanced trade ties, which could benefit both European businesses and the Chinese economy. As global trade dynamics shift, fostering fair relations is crucial for sustainable growth.

— Curated by the World Pulse Now AI Editorial System