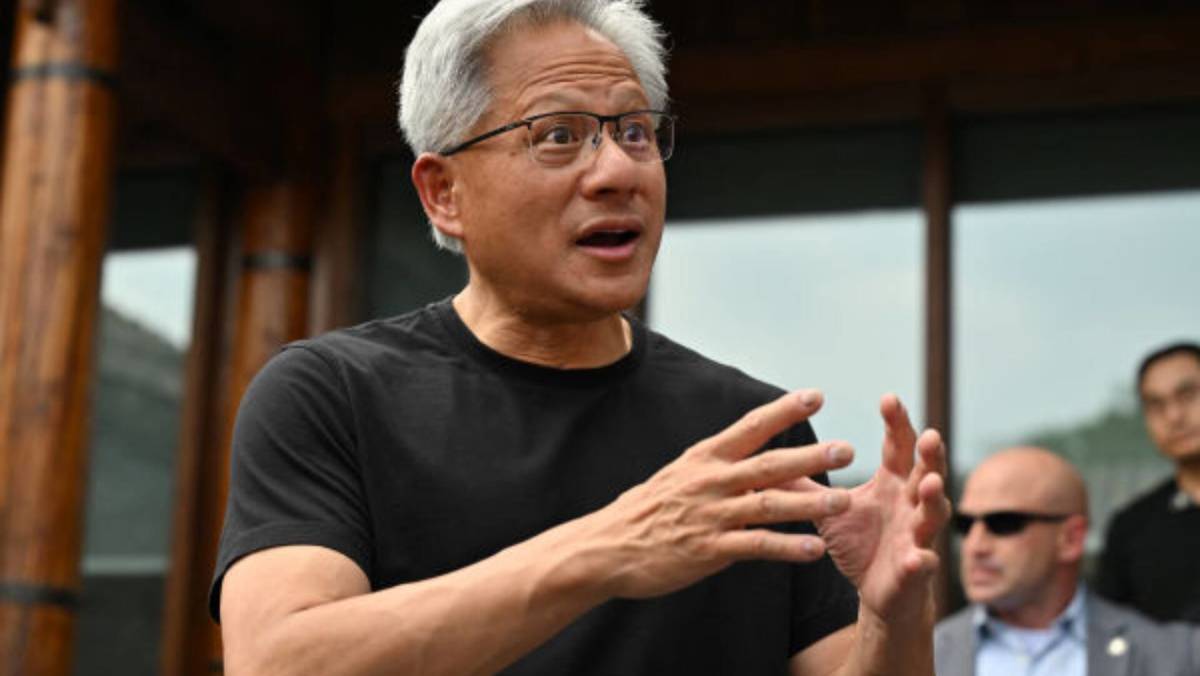

Weekly Market Wrap: Intel, Nvidia and Electronic Arts made major news

NeutralFinancial Markets

This week in the market, major players like Intel, Nvidia, and Electronic Arts made headlines, reflecting the ongoing trends and shifts in the tech and gaming sectors. Understanding these developments is crucial for investors and enthusiasts alike, as they can influence market dynamics and investment strategies.

— Curated by the World Pulse Now AI Editorial System