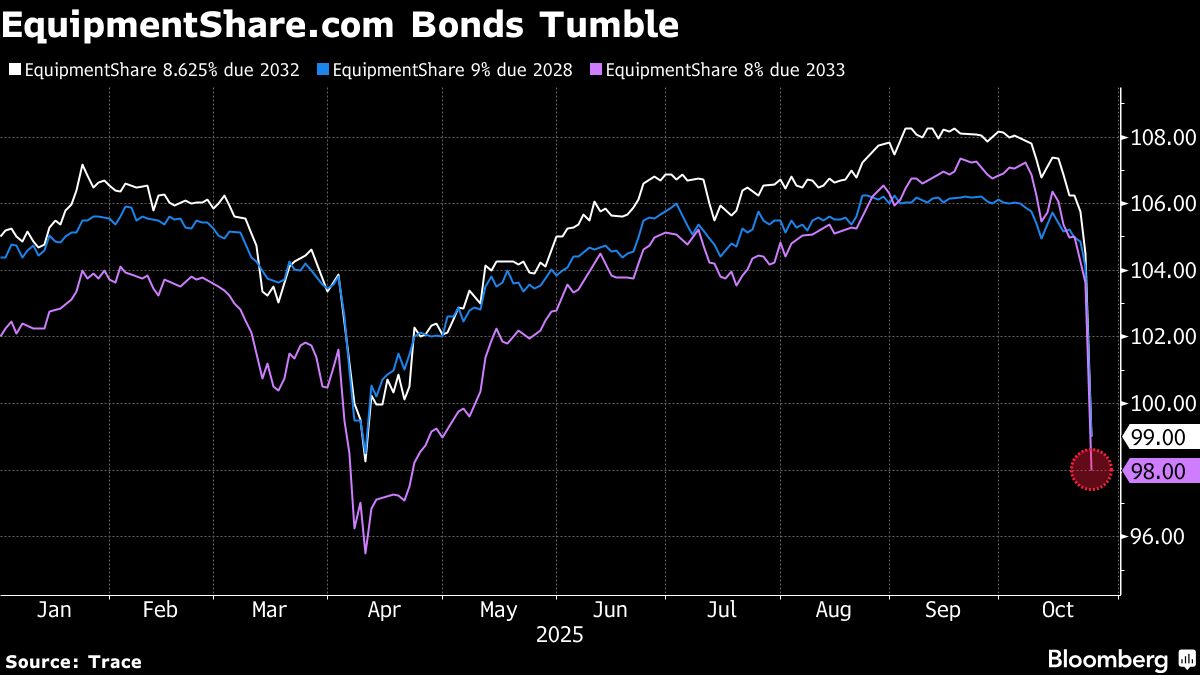

EquipmentShare Bonds Sink as Ousted Board Member Alleges Fraud

NegativeFinancial Markets

EquipmentShare, a Missouri-based construction equipment leasing company, is facing a significant setback as the prices of its bonds plummeted due to a legal dispute with a former board member who has made serious allegations of fraud and misconduct. This situation is crucial as it not only impacts the company's financial stability but also raises concerns about governance and trust in the private bond market, especially for companies that rely heavily on such funding for growth.

— Curated by the World Pulse Now AI Editorial System