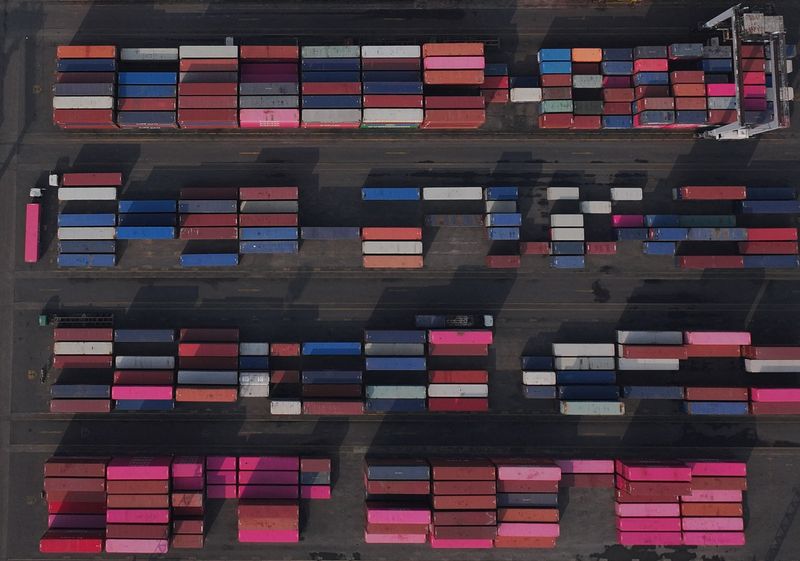

Indonesia imports rise stronger-than-expected 7.17% y/y in September, data shows

PositiveFinancial Markets

Indonesia's imports have surged by an impressive 7.17% year-on-year in September, surpassing expectations. This growth is significant as it indicates a robust demand for goods, which could signal a strengthening economy. Increased imports often reflect consumer confidence and can lead to greater economic activity, making this development noteworthy for both local businesses and international trade partners.

— Curated by the World Pulse Now AI Editorial System