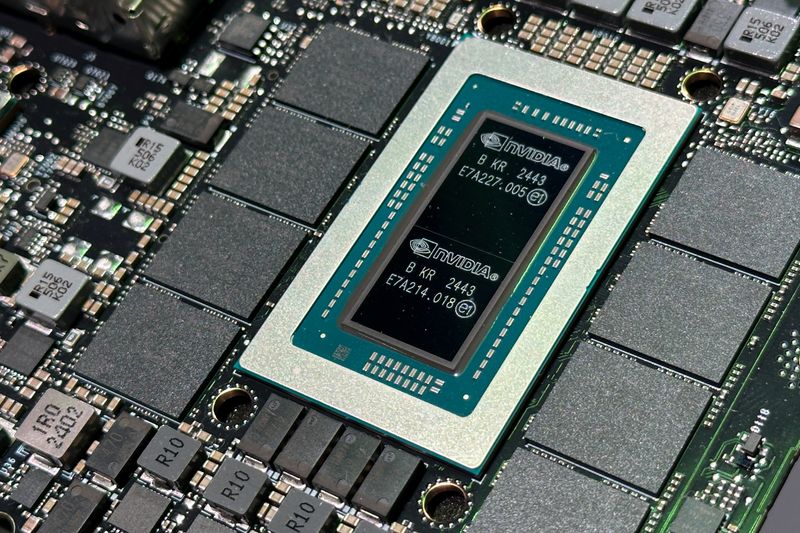

State And Local Pensions Must Confront AI’s Systemic Risks

NeutralFinancial Markets

State and local pensions are facing significant challenges due to the systemic climate risks posed by data centers. As these facilities continue to grow, their impact on investment portfolios becomes more pronounced. It's crucial for pension funds to collaborate with the tech industry to mitigate these risks, ensuring the sustainability of their investments and the financial security of retirees. Addressing these issues now can lead to more resilient pension systems in the future.

— Curated by the World Pulse Now AI Editorial System