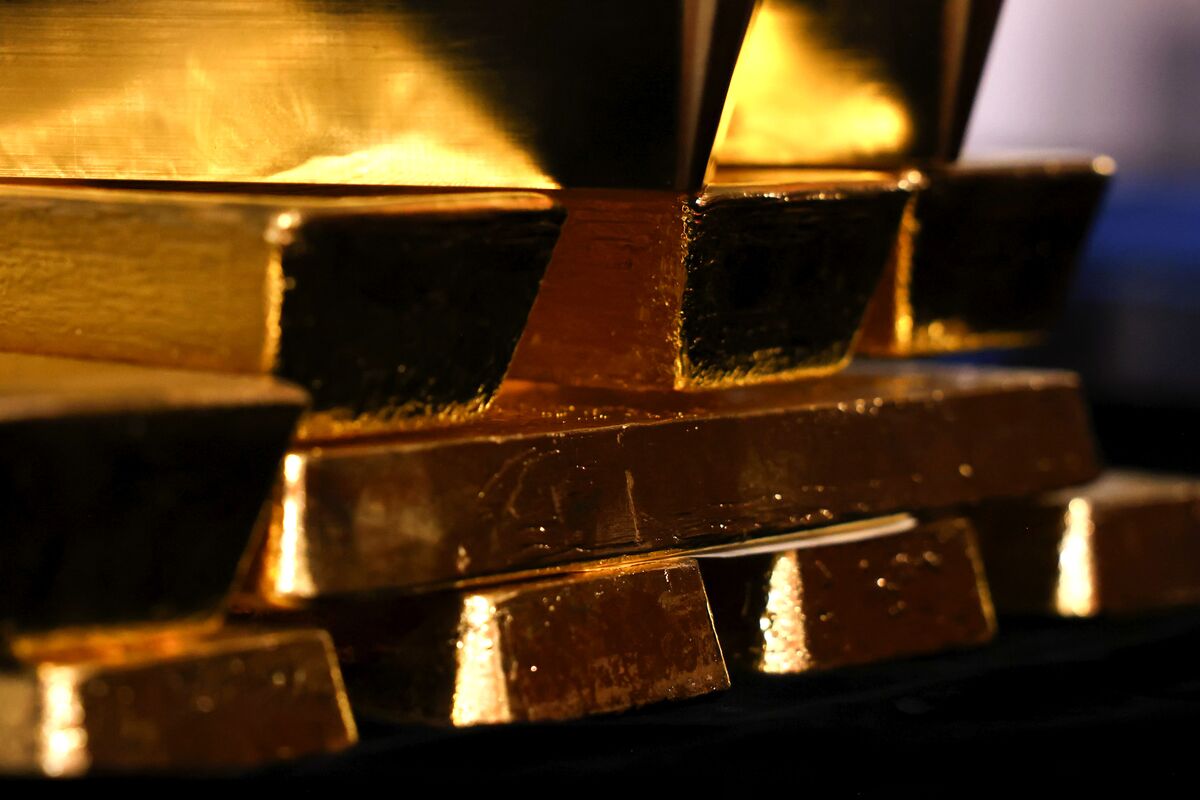

Amundi Physical Gold ETC issues 630,000 new securities

PositiveFinancial Markets

Amundi has issued 630,000 new securities for its Physical Gold ETC, reflecting a strong demand for gold investments. This move is significant as it indicates growing investor confidence in gold as a safe-haven asset, especially in uncertain economic times. By increasing the availability of these securities, Amundi is making it easier for investors to gain exposure to gold, which can help diversify their portfolios and hedge against inflation.

— Curated by the World Pulse Now AI Editorial System