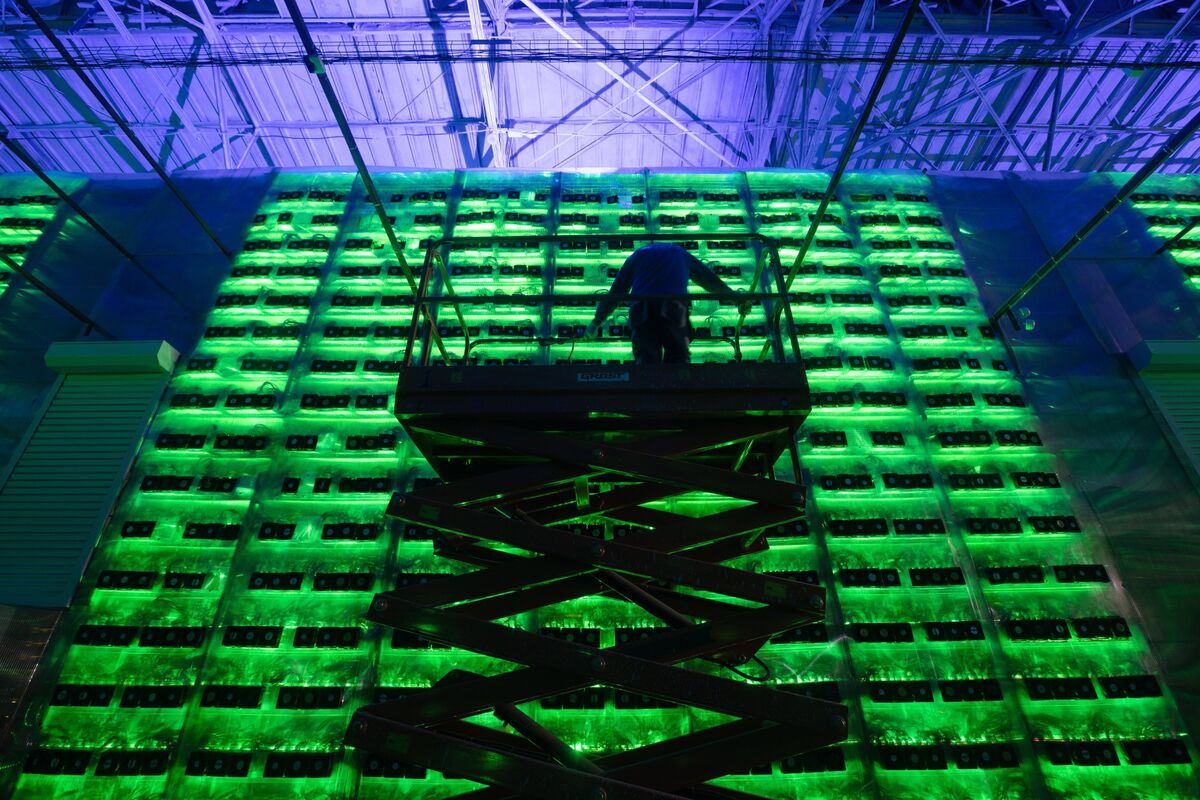

Beware the bubble in bitcoin treasury companies

NegativeFinancial Markets

Bitcoin treasury companies are facing significant challenges, as highlighted by Matthew Partridge's warning to short these investments. This matters because it reflects a broader trend in the cryptocurrency market, where volatility and uncertainty are leading to financial instability for companies that once thrived on bitcoin's popularity.

— Curated by the World Pulse Now AI Editorial System