From Sports to AI, America Is Awash in Speculative Fever. Washington Is Egging It On.

NeutralFinancial Markets

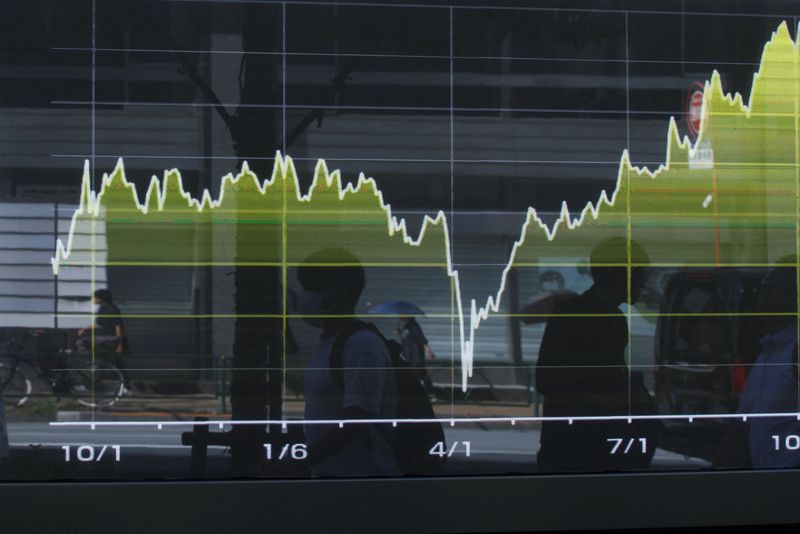

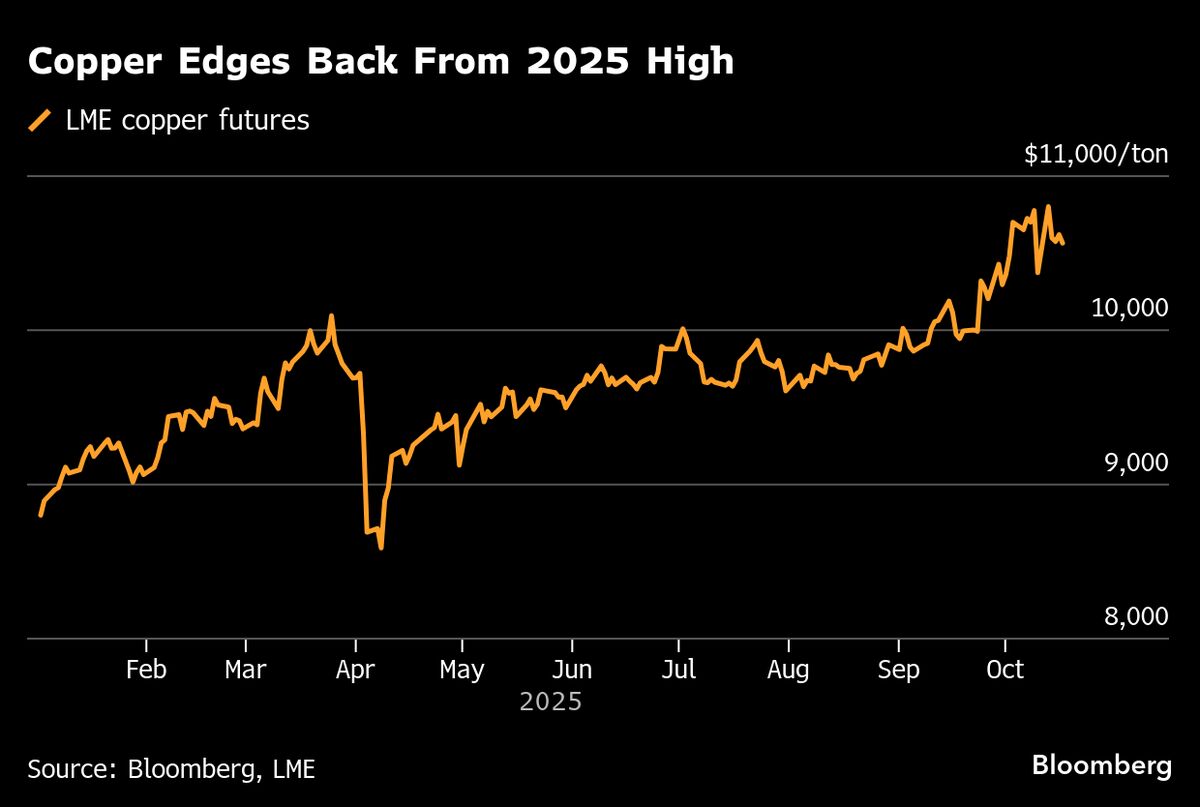

The current trend in America sees a surge of working-class investors diving into stocks, betting, and cryptocurrency, reflecting a new era of democratic finance. However, this speculative fever raises concerns about whether these investors are genuinely benefiting or simply the last ones to join a potentially risky party. As Washington encourages this trend, the implications for the economy and individual investors could be significant, making it a crucial moment to watch.

— Curated by the World Pulse Now AI Editorial System