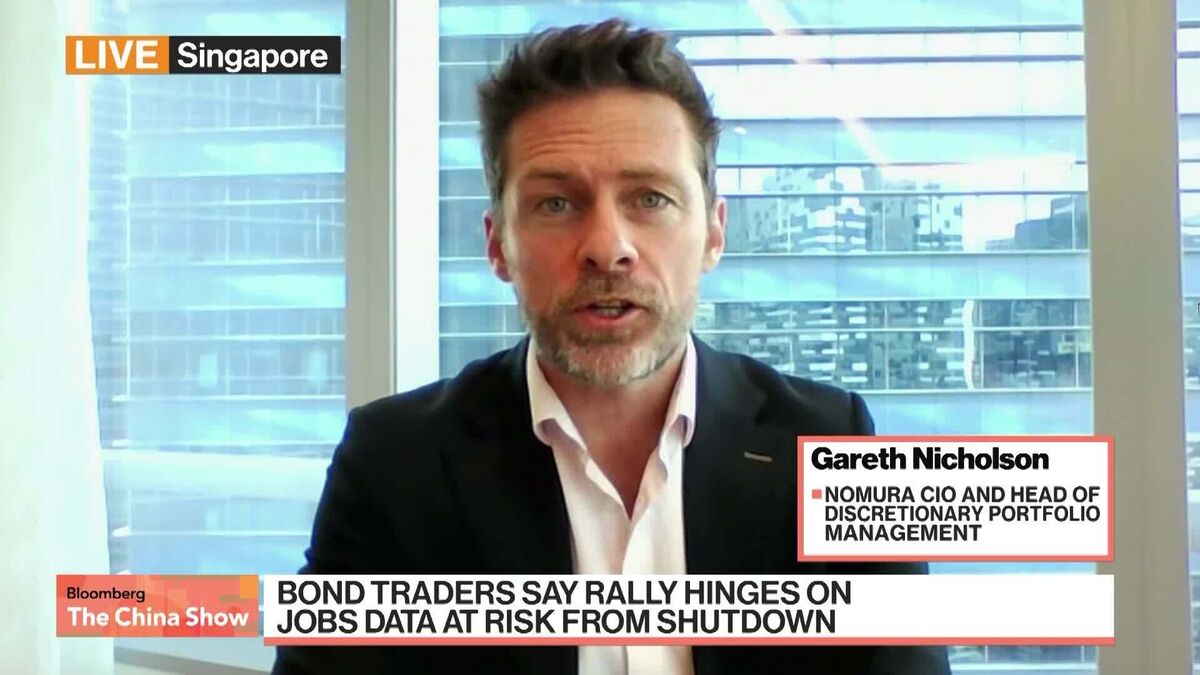

Nomura to boost rates and FX trading units, sees more market volatility

PositiveFinancial Markets

Nomura is set to enhance its rates and foreign exchange trading units, anticipating increased market volatility. This move is significant as it positions the firm to capitalize on potential trading opportunities amid fluctuating market conditions, which could lead to greater profitability and a stronger competitive edge in the financial services sector.

— Curated by the World Pulse Now AI Editorial System