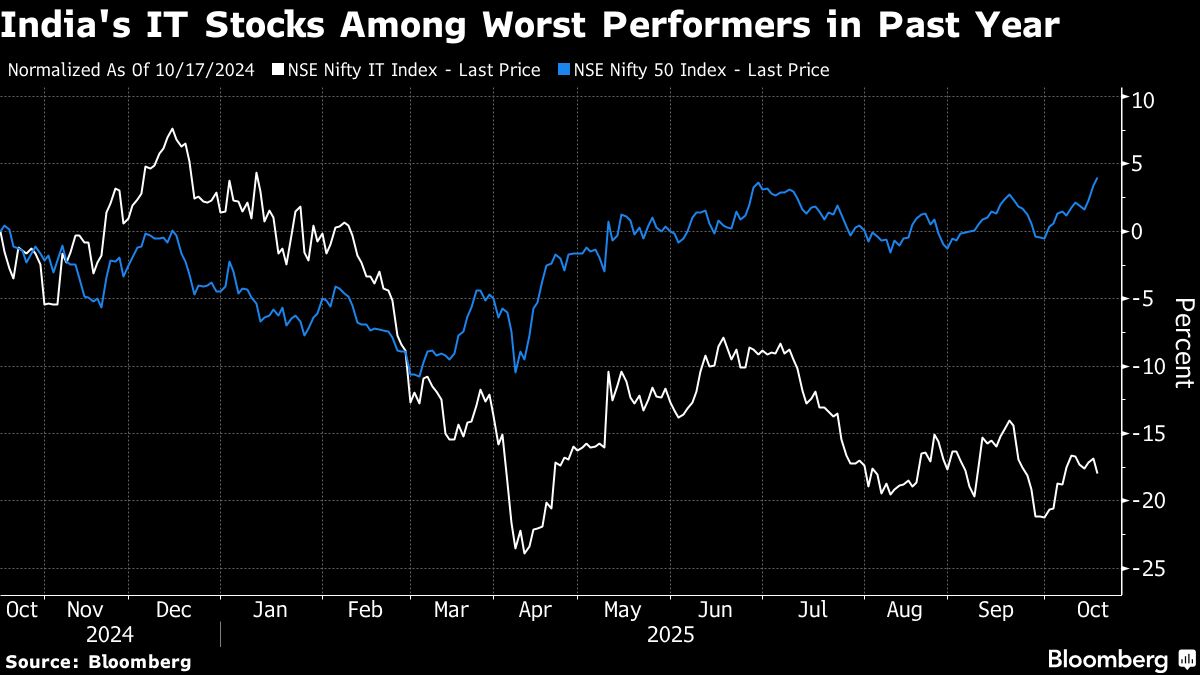

Infosys, Wipro Strong Earnings Growth Cheers Despite India's Shaky Economy

PositiveFinancial Markets

Infosys and Wipro have reported strong earnings growth, which is particularly noteworthy given the current challenges facing India's economy. This positive performance not only reflects the resilience of these tech giants but also offers a glimmer of hope for investors looking for stability in a shaky market. As these companies continue to thrive, it could signal a potential turnaround for the broader economic landscape in India.

— Curated by the World Pulse Now AI Editorial System