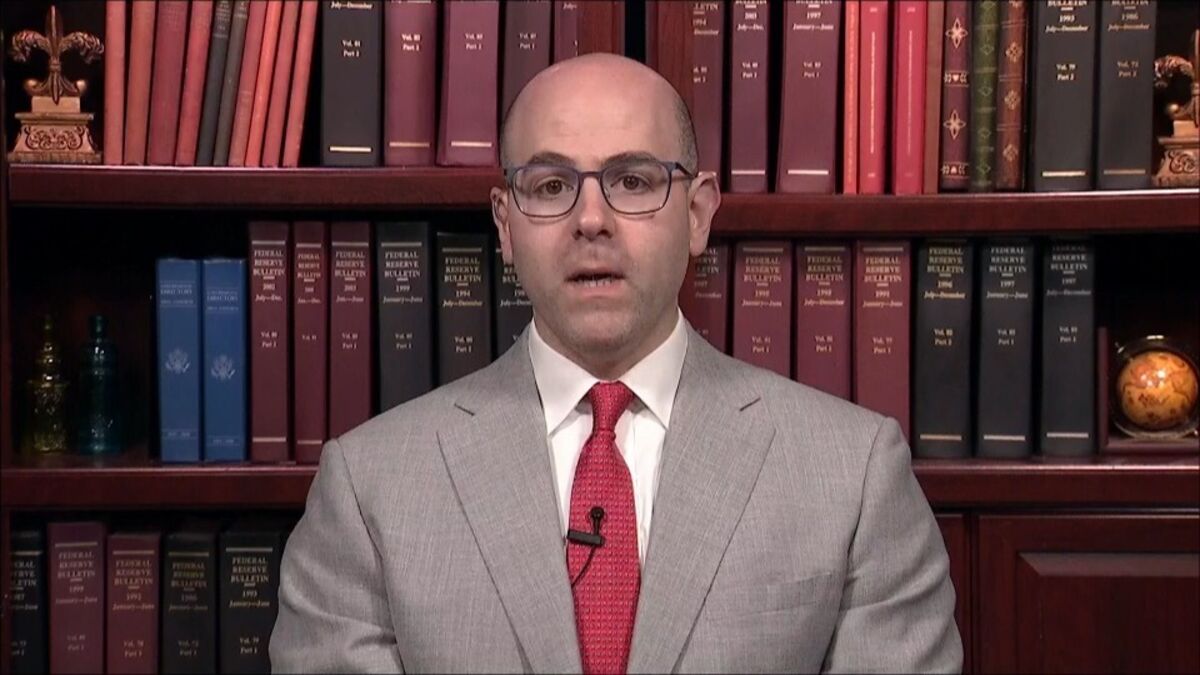

Bank of Canada’s Macklem backs infrastructure spending in Bloomberg interview

PositiveFinancial Markets

In a recent interview with Bloomberg, Bank of Canada Governor Tiff Macklem expressed strong support for increased infrastructure spending. He emphasized that such investments are crucial for stimulating economic growth and enhancing the country's competitiveness. This endorsement is significant as it highlights the government's focus on long-term economic strategies, especially in the wake of recent challenges. Macklem's comments could influence policymakers and investors, signaling a commitment to infrastructure development as a pathway to recovery.

— Curated by the World Pulse Now AI Editorial System