IPO Market on Path to Normalization, UBS McCartney Says

PositiveFinancial Markets

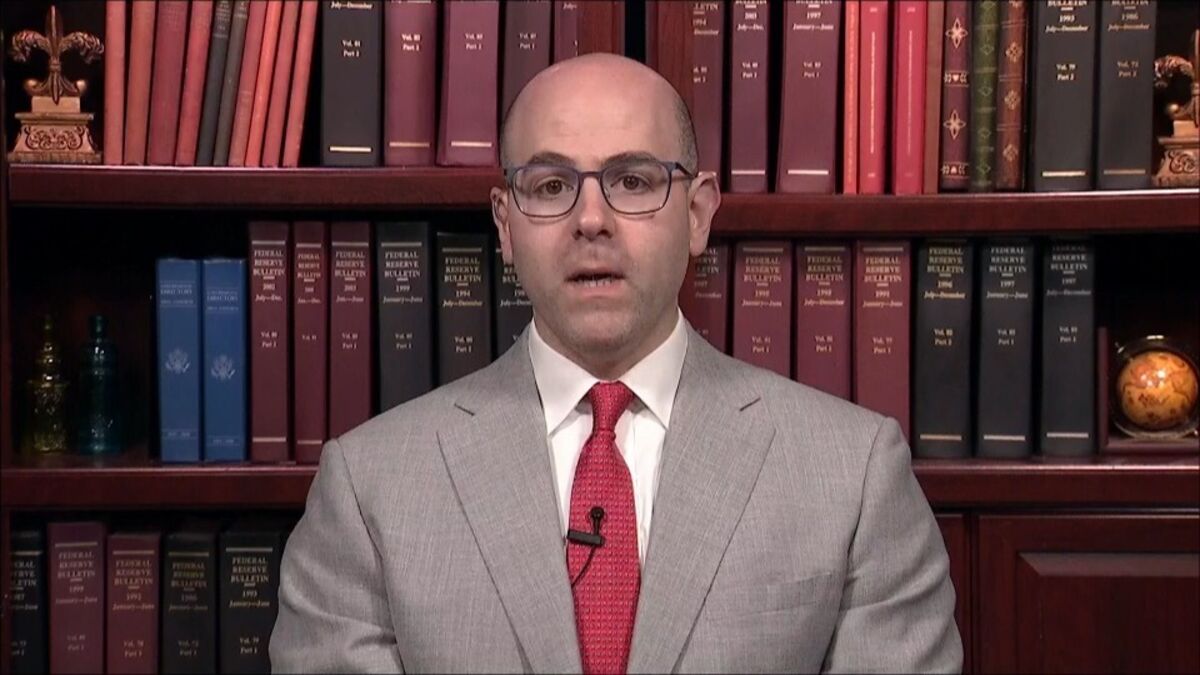

Gareth McCartney from UBS has shared an optimistic outlook on the IPO market, describing it as traditionally cyclical but currently robust. Speaking on Bloomberg's 'The Pulse', he highlighted the strong IPO pipeline and the various themes available for investors. This insight is significant as it suggests a potential recovery and growth in the IPO sector, which could attract more investments and boost market confidence.

— Curated by the World Pulse Now AI Editorial System