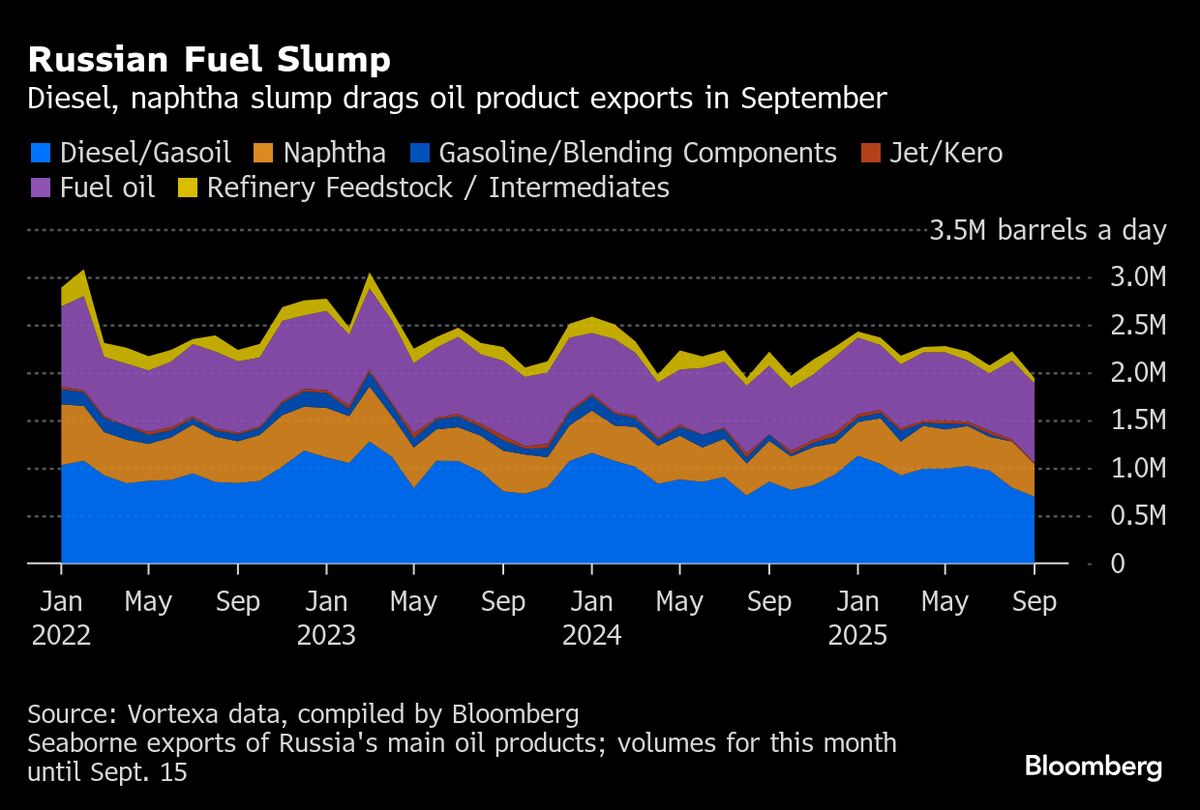

Oil gains as tension flares in Europe, Middle East

PositiveFinancial Markets

Oil prices are on the rise as tensions escalate in Europe and the Middle East, reflecting market reactions to geopolitical uncertainties. This increase is significant as it can impact global economies, fuel prices, and consumer behavior, highlighting the interconnectedness of international relations and energy markets.

— Curated by the World Pulse Now AI Editorial System