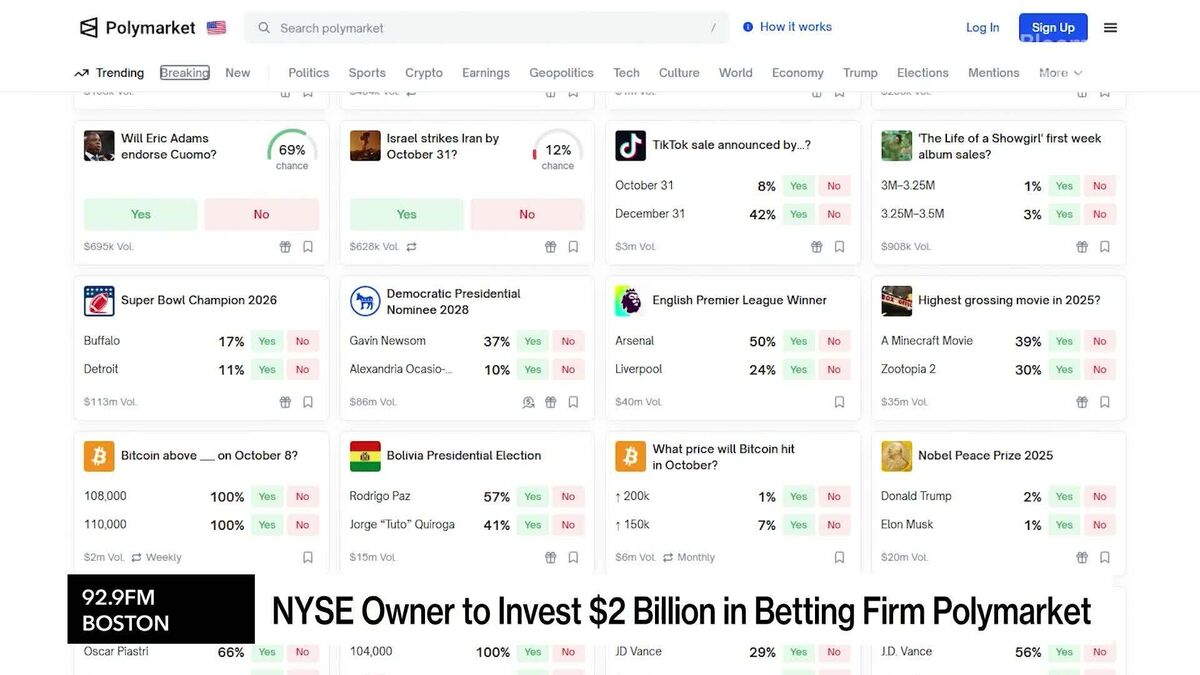

NYSE Owner to Invest $2 Billion in Betting Firm Polymarket

PositiveFinancial Markets

Intercontinental Exchange Inc., the owner of the New York Stock Exchange, is making a significant move by investing up to $2 billion in Polymarket, a crypto-based betting platform. This investment values Polymarket at around $8 billion and positions ICE as a key player in the event-driven data market. By becoming a global distributor of Polymarket's data, ICE will provide valuable sentiment indicators on various topics, enhancing market insights for customers. This partnership highlights the growing intersection of traditional finance and innovative betting platforms.

— Curated by the World Pulse Now AI Editorial System