New York Stock Exchange Owner Bets $2 Billion On Polymarket Comeback

PositiveFinancial Markets

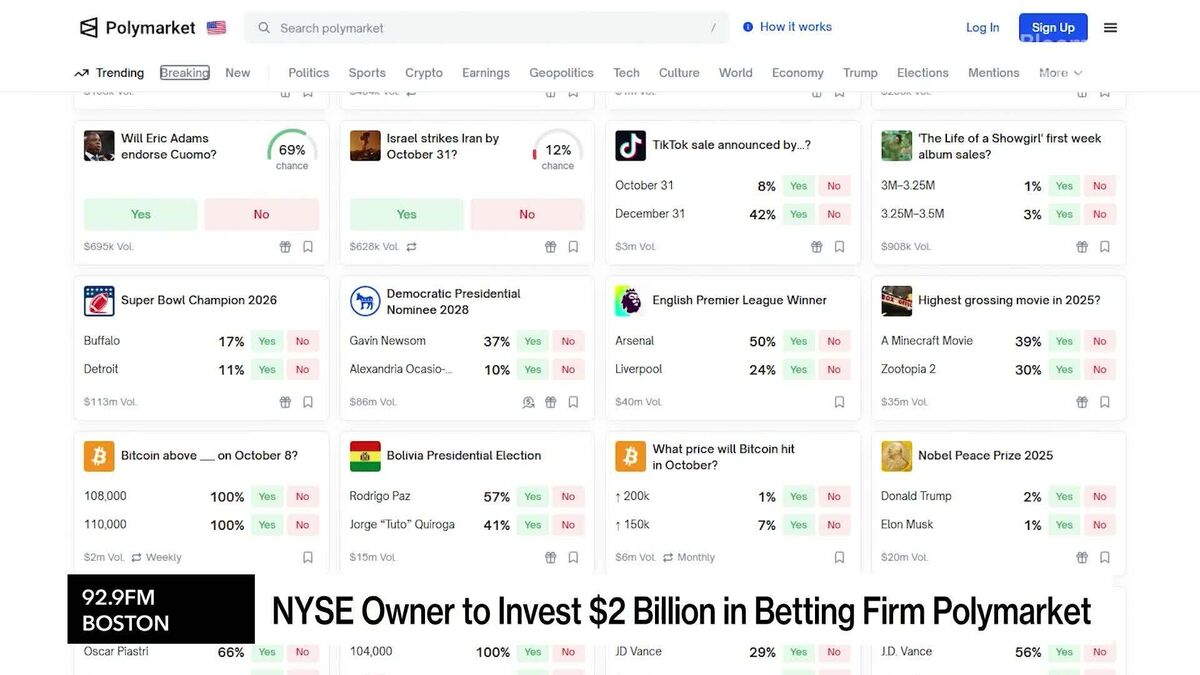

The New York Stock Exchange's owner is making a bold move by investing $2 billion in Polymarket, a crypto-based prediction market that has faced its share of challenges, including fines and a ban from the U.S. This significant investment signals a shift in Wall Street's attitude towards innovative financial platforms, highlighting a growing acceptance of cryptocurrency and alternative markets. It matters because it could pave the way for more mainstream adoption of such technologies, potentially reshaping the future of trading and investment.

— Curated by the World Pulse Now AI Editorial System