New York Stock Exchange parent company invests $2 billion in Polymarket at $9 billion valuation

PositiveFinancial Markets

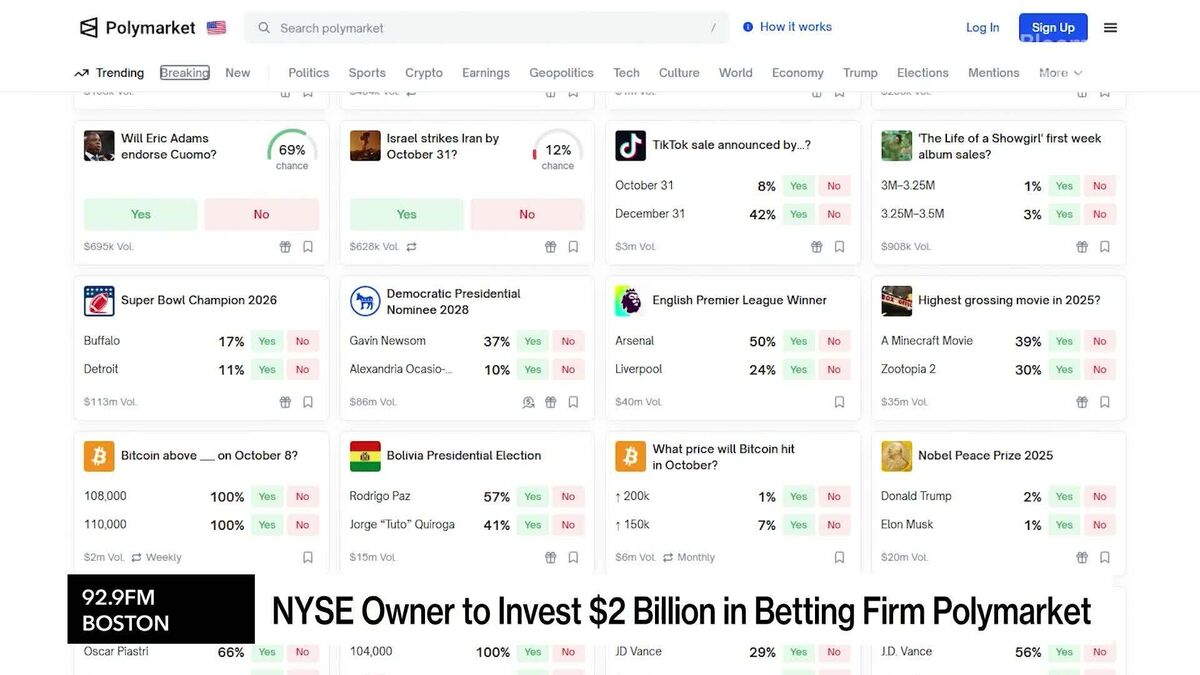

The parent company of the New York Stock Exchange has made a significant move by investing $2 billion in Polymarket, valuing the prediction market at an impressive $9 billion. This investment comes on the heels of a previous funding round that had already valued Polymarket at over $1 billion. This development is noteworthy as it highlights the growing interest and confidence in prediction markets, which could reshape how we think about forecasting and betting on future events.

— Curated by the World Pulse Now AI Editorial System