Zions, Western Alliance Disclose Bad Loans

NegativeFinancial Markets

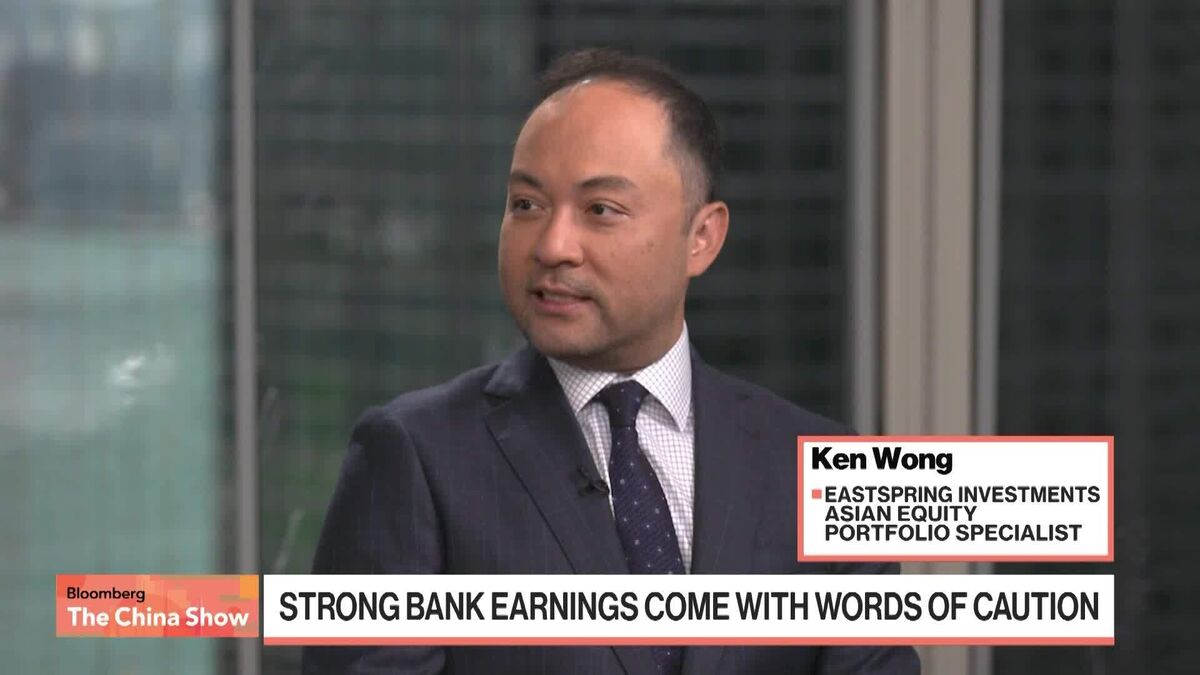

Zions Bancorp and Western Alliance Bancorp have recently revealed significant issues with their loan portfolios, raising concerns in the banking sector. Zions reported a $50 million charge-off linked to a loan from its subsidiary, California Bank & Trust, while Western Alliance is facing challenges with a borrower who failed to secure collateral. These disclosures highlight the ongoing risks in the banking industry, particularly regarding loan underwriting practices and fraud allegations, which could impact investor confidence and regulatory scrutiny.

— Curated by the World Pulse Now AI Editorial System