Block Trades Reach Record in Japan’s Drive for Corporate Reform

PositiveFinancial Markets

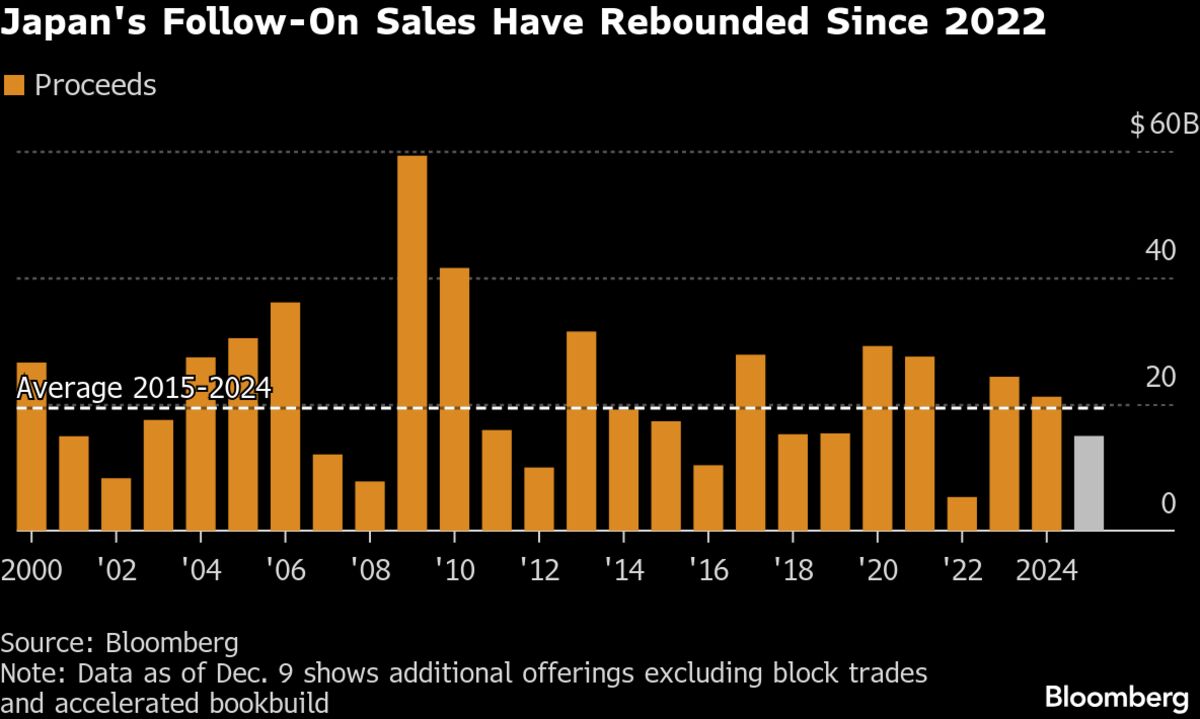

- Japan's stock market is experiencing a historic surge in block trades as companies reduce cross-shareholdings to enhance corporate governance, marking a significant shift in investment strategies. This trend reflects a broader commitment to improving transparency and accountability within Japanese corporations.

- The rise in block trades is crucial for companies as it indicates a move towards more efficient capital allocation and governance practices, potentially attracting foreign investment and boosting overall market confidence.

- This development occurs against a backdrop of fluctuating share prices and a notable decline in the number of listed companies in Japan, highlighting ongoing challenges in the market. Analysts remain optimistic about Japan's economic resilience, despite these hurdles, suggesting a complex interplay of growth opportunities and structural reforms.

— via World Pulse Now AI Editorial System