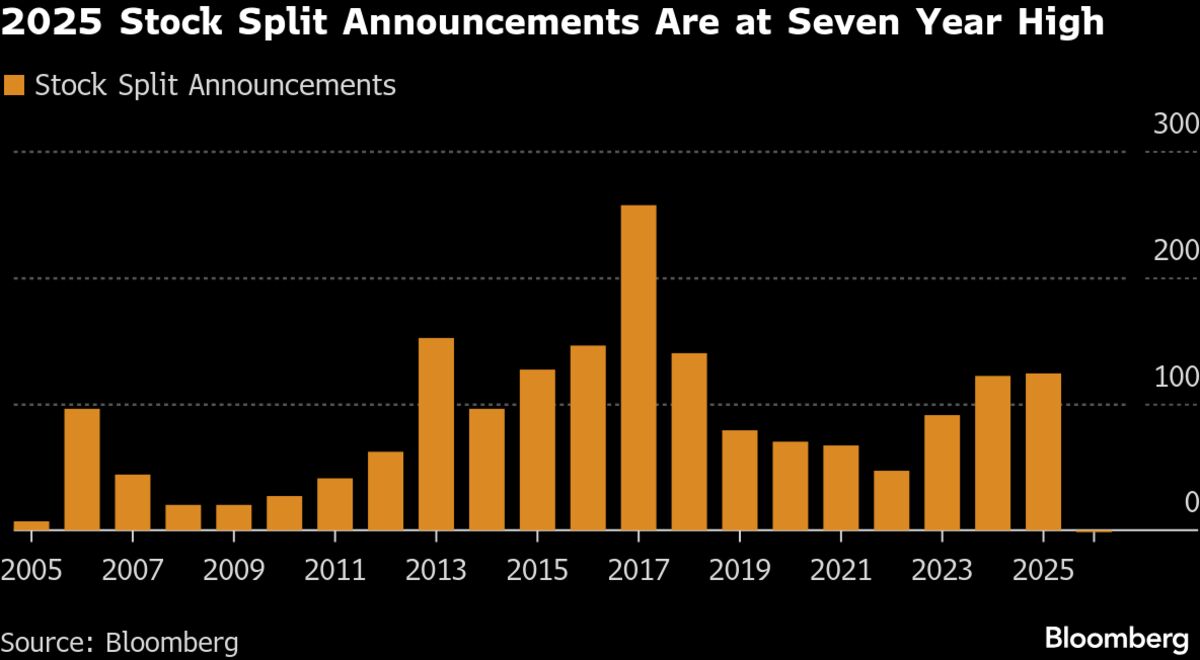

Surging Share Prices in Japan Lead to a Wave of Stock Splits

PositiveFinancial Markets

- Japan's stock market has reached unprecedented heights this year, prompting a surge in stock splits among companies as they aim to attract more individual investors. Despite the overall market success, many retail investors find it challenging to participate in this upward trend due to high share prices.

- The wave of stock splits is significant as it may enhance liquidity and accessibility for individual investors, potentially broadening the market's participant base and fostering a more inclusive investment environment in Japan.

- This development occurs against a backdrop of mixed economic signals, including a decline in the number of listed companies and fluctuations in household spending, suggesting that while the stock market thrives, underlying economic challenges persist, raising questions about the sustainability of this growth.

— via World Pulse Now AI Editorial System